Following are my personal comments on specific markets and issues. I chart markets for a hobby and my comments are the result. They are not recommendations to buy or sell anything and should not be thought of as such. They are for entertainment purposes only so enjoy.

Please remember, the following is pure speculation based only on my experience and chart patterns. "Every sunken ship has a room full of charts."

David Bruce Edwards

Jan. 3, 2026

Note - I got a new wider screen monitor and when I look at this web site with the screen size in full, the site spacing does not come out properly. By making the window less wide all of the text and graphics slide into place. Perhaps you are having the same experience. DBE.

As usual, I will show pictures and graphs found on Zerohedge.com, Sentimentrader.com, which include the Seasonality charts and charts made on Barchart.com. I will also mention "cycle low timing bands" suggested by another market website to which I subscribe, Cyclesman.com.

Early this morning (Saturday) the U.S. invaded Venezuela and removed President Maduro and his wife. It was done with a small group of U.S. forces. It is probable that they were helped or at least, not hindered by elements of the Venezuelan military. Aside from being a hub for the drug trade, Venezuela was happy to take money and munitions from Russian and China, offering them a staging ground for influence in the hemisphere. They also allowed Hezbollah the use of an island for terrorist training. Smart people will debate "what it means" and "was it legal" over the next few days. Our past regime change operations around the world did not work out as planned with new leaders being hostile and just as corrupt as the old. Analysts will talk about the potential for oil production and exports to resume, depressing prices. Under the Maduro and Chavez governments, the country's infrastructure was ignored. Upgrading Venezuela's oil industry will take billions of Dollars and years to complete. Their heavy crude oil will compete with Canada's.

The Trump administration knows that the focus of governments south of our border will not be on real economic development until they turn from the drug economy (and human smuggling) to real economic development. My guess is that this is behind some of our foreign policy. I did a lot of business in Central and South America between 1992 and 2007. The corruption and economic distortion from the flow of drug proceeds is immense and not grasped by those who have not done business there. The actual paper Dollars from drug sales (and Euros and Canadian Dollars) come back into these countries. The flow of cash to criminal groups means that they can fund a vast network of employees and offer politicians and law enforcement sums of money that they would never make legally. Often, the choice is to take the money and do the bidding of drug cartels or have family members killed before they kill you. As long as this money is flowing, there is no need for leaders to enact policies that help the economies of these countries and improve the daily lives of their citizens. Here is an example of the economic distortion. The flood of un-laundered paper currency in to the region is so great that most of the time, Dollars trade at a discount to face value in the free market. The discount increases around major holidays such as Christmas, when family members, working in the U.S., send money home. Money launderers compete to place these Dollars in financial institutions. Let's say that in Colombia, the discount for paper Dollars is 10% compared to the official exchange rate. Any transaction that gets the money into the banking system and costs less than 10% turns a profit. The Andean Free Trade agreement allows goods to flow tariff free between countries in the region, . This allows launderers to buy gold for cash in Peru, Ecuador, Bolivia and other areas at a premium over the London Fix then sell the gold to legal regional buyers who pay for the gold by wiring money into the banking system. Coffee, cattle and other things can also be traded based on the math of drug money, distorting regional markets and prices. In 2004 I was in Paramaribo, Suriname. At the time, the country had two large casinos. There were reports of people coming to them with huge amounts of cash and gamboling until they lost it all. The owners of the casinos deposited their "profits" into the banking system. It was a money laundering operation.

If we can remove a leader in Venezuela, what does this say to China and Russia? Some analysts argue that the world is returning to a "spheres of influence" model where the strongest economic and military powers exercise regional control. The major powers will still compete and try to undermine the economies of their rivals by offering better deals to leaders from the competing spheres. This will include lots of dirty tricks and covert operations. Does this mean that China can take Taiwan and Russia can have most of Ukraine? We will see in the coming years.

There was little in the way of economic data over the last two weeks and few people were paying attention.

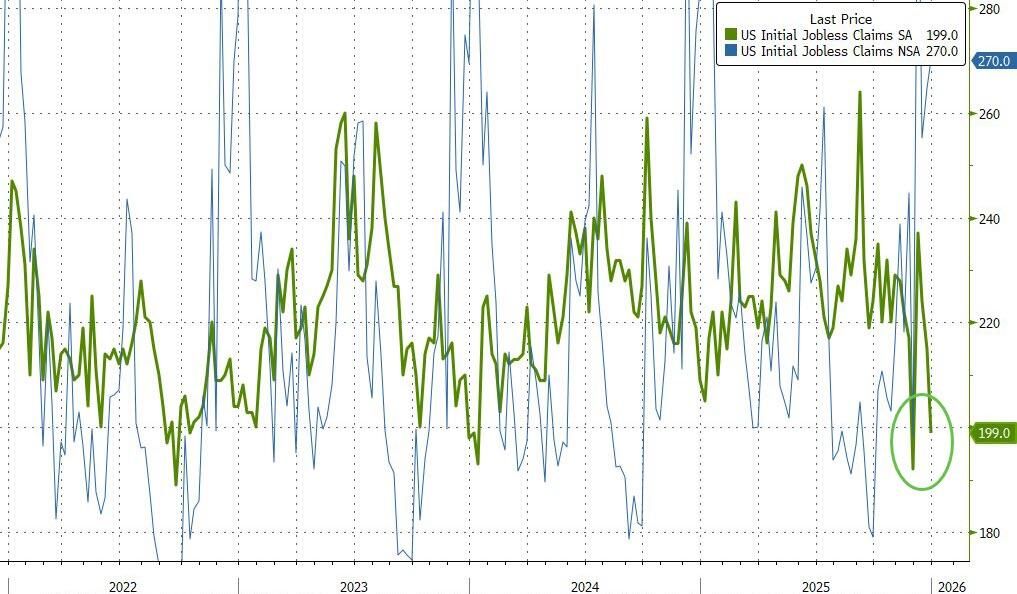

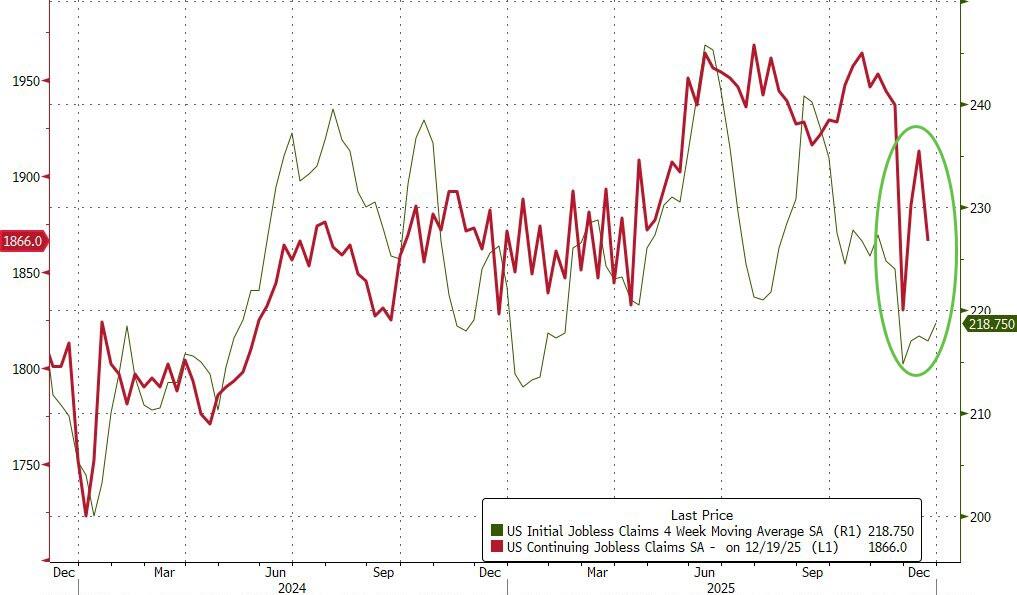

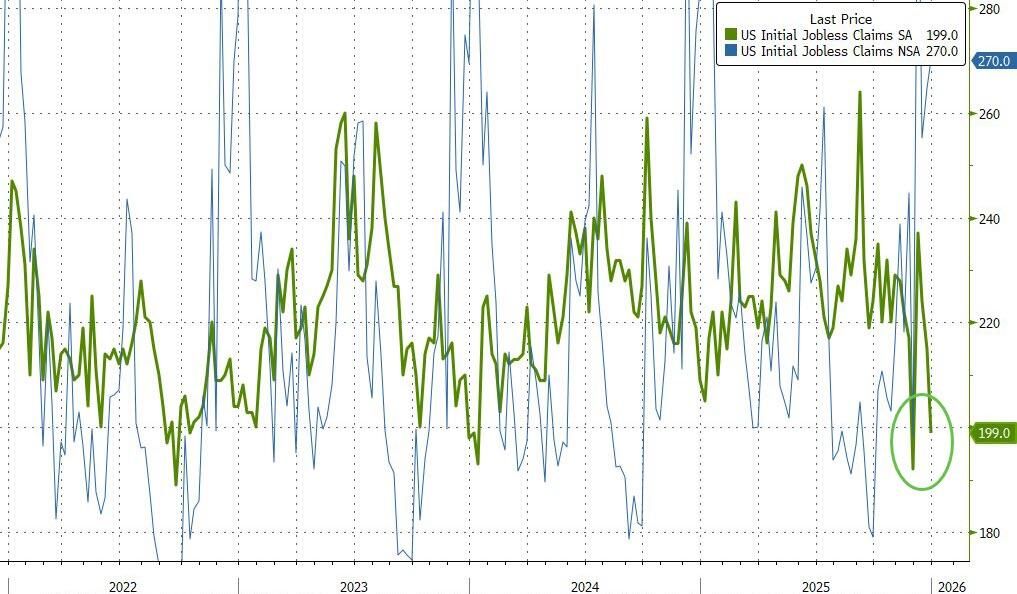

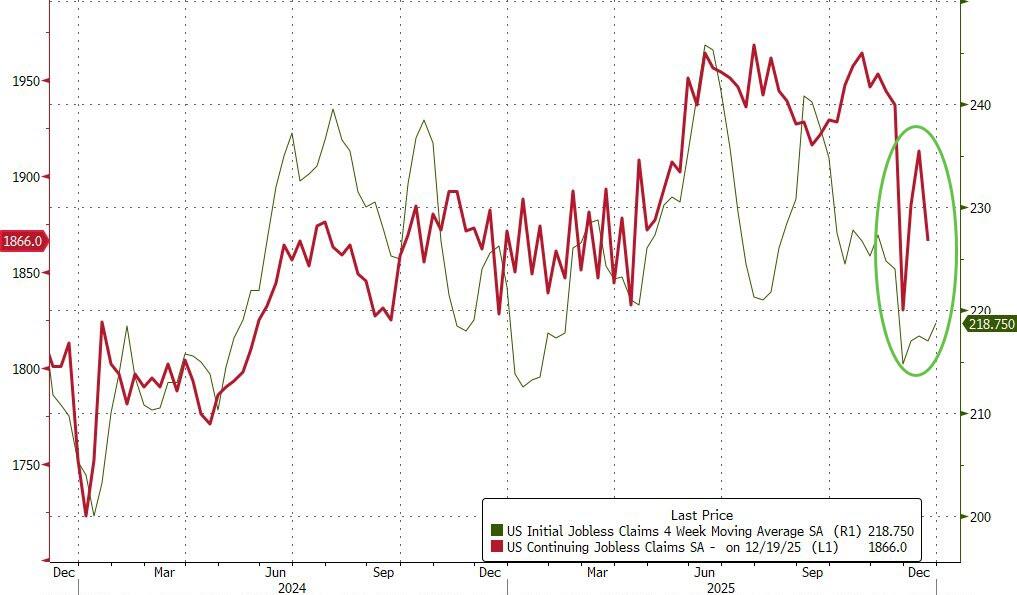

On the left is the latest for New Claims for Unemployment Benefits. The green line is the seasonally adjusted number. The blue line shows the unadjusted data. Analysts pay attention to the seasonally adjusted data. It came in at 199,000, a very low reading. Unadjusted New Claims were 270,000. Continuing Claims (red line, right side graph) fell to 1,866,000. January numbers will better reflect what is going on with jobs.

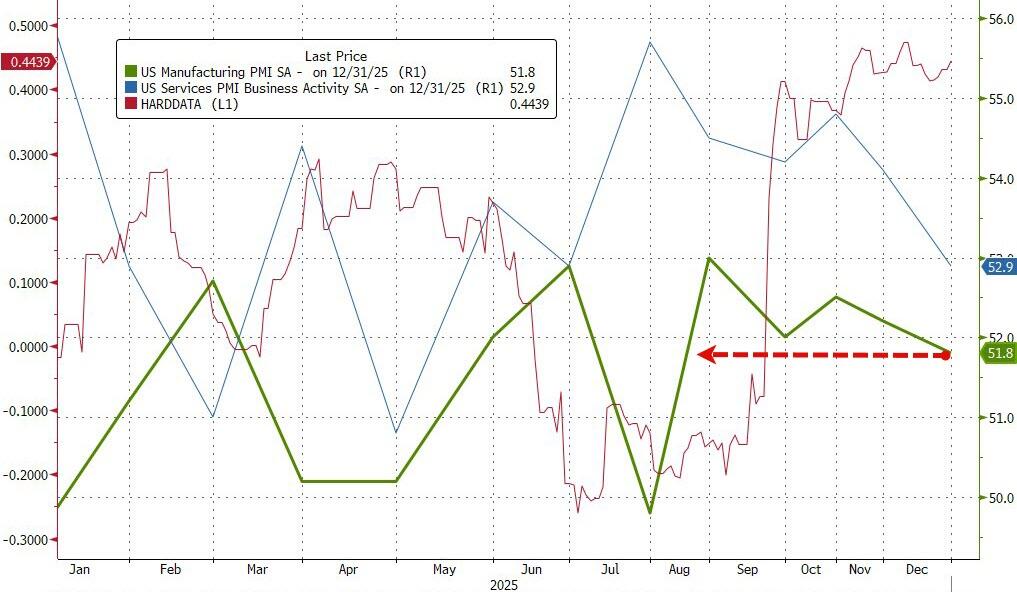

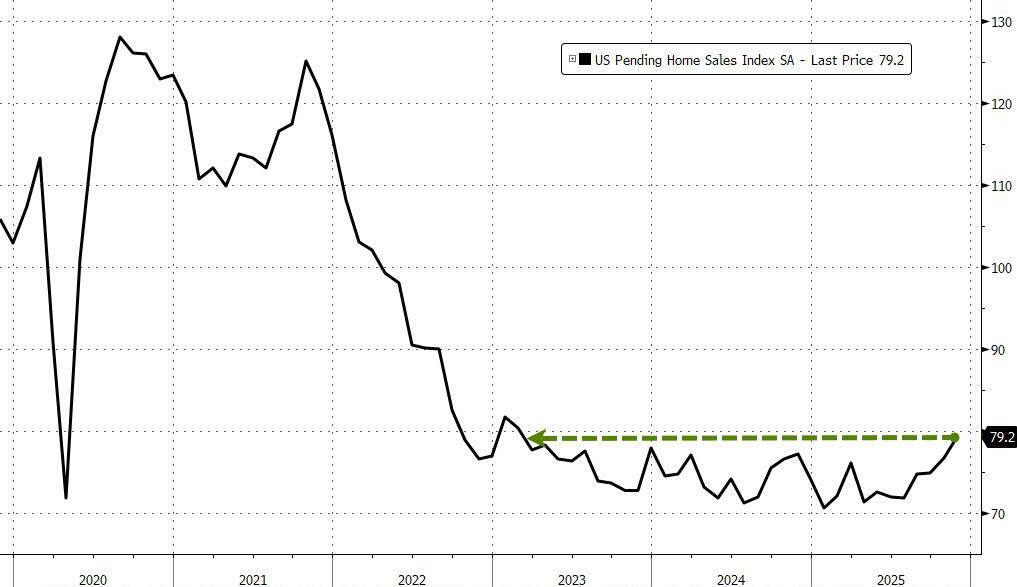

The left side graph shows the result of an S&P poll of purchasing managers from manufacturing (green) and services (blue) industries. Both lines were just above the 50 level. Anything above 50 is an increase. The red line shows "hard data" from recent official government reports. Purchasing managers also said that the prices they were paying for supplies and raw materials were down a bit but so were the prices for the goods and services they produce. On the right is the latest on pending home sales and they were the best since 2023. Prices are dropping in some regions and mortgage rates averaged 6.3% last month.

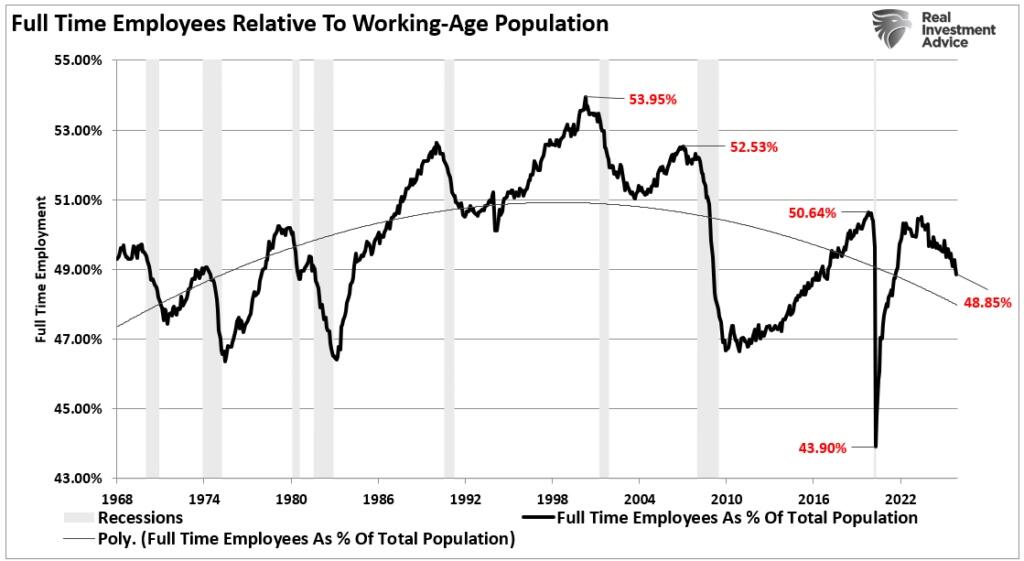

A number of well known analysts are focusing on the Trump era demographic trends in the U.S. They say that with deportations and self deportations, very little immigration, a low birth rate and baby boomers reaching the end of their life's expectancy, the country's population is dropping. Full employment will continue even if fewer new jobs are added to the economy. The domestic demand for goods and services is ultimately a function of the number of people with money to spend so the number of things sold will also drop. This is happening all over the world with countries hoping that exports will lift demand. The problem is that fewer consumers world wide also mean less demand for imported goods. Politicians will respond with protectionist policies to keep domestic prices from falling.

A different employment picture is presented by the graph on the left from Real Investment Advice. The update two weeks ago included data from the latest employment report. Jobs came in higher than projected but there was a continuing shift away from full time jobs toward part time positions. Full time employment as a percent of the working age population is dropping. The RIA analysts say that full time employment is important because those jobs come with benefits and a greater sense of security and willingness to consume. 70% of our economy is driven by consumer spending and without full time employment trending higher, spending is likely to be muted. They expect this to show up in 2026 unless the trend in full time jobs improves.

What happened to the Santa Clause Rally?

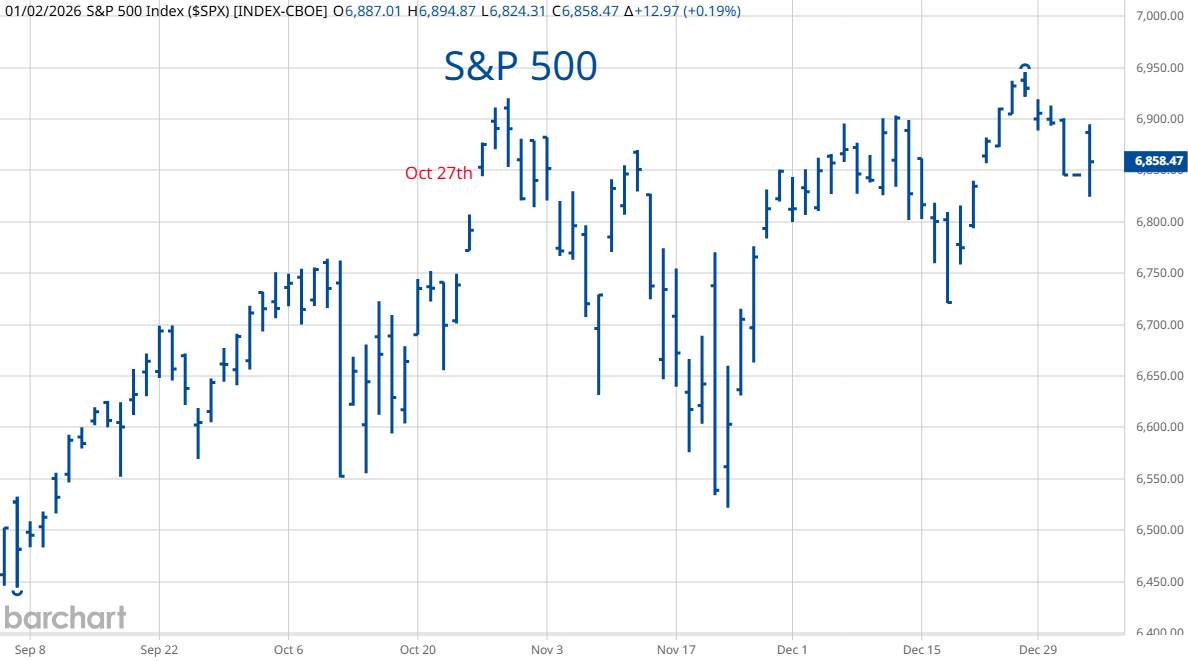

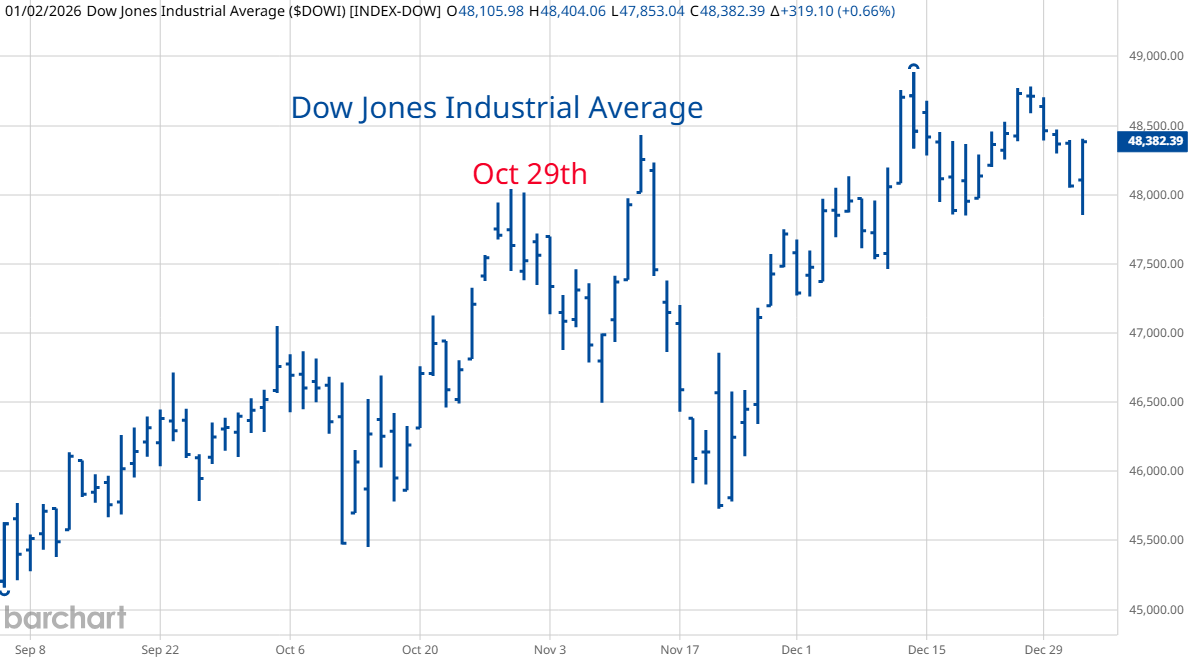

The constant bull market commentary on financial channels is at odds with the charts. On the left is the last four months of the S&P 500. It recently made new highs at levels slightly above end of October tops. On Friday it closed in the range of October 27th's trading. The Dow Jones Industrial Average also fell into October's range before rallying into the close in thin trading.

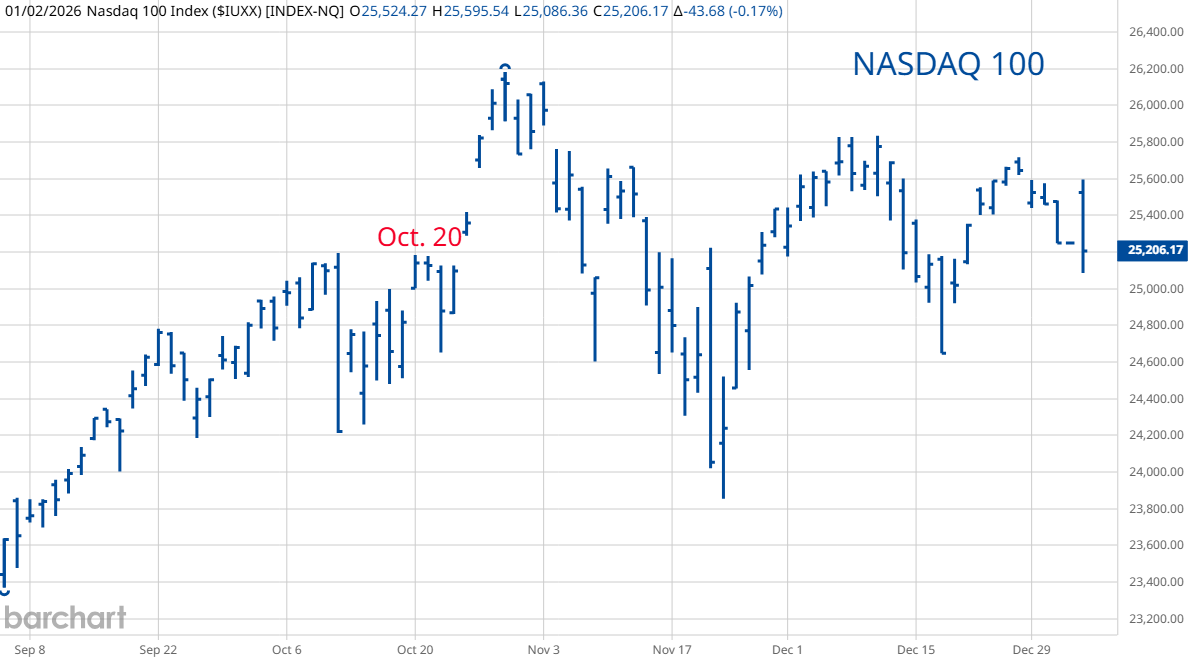

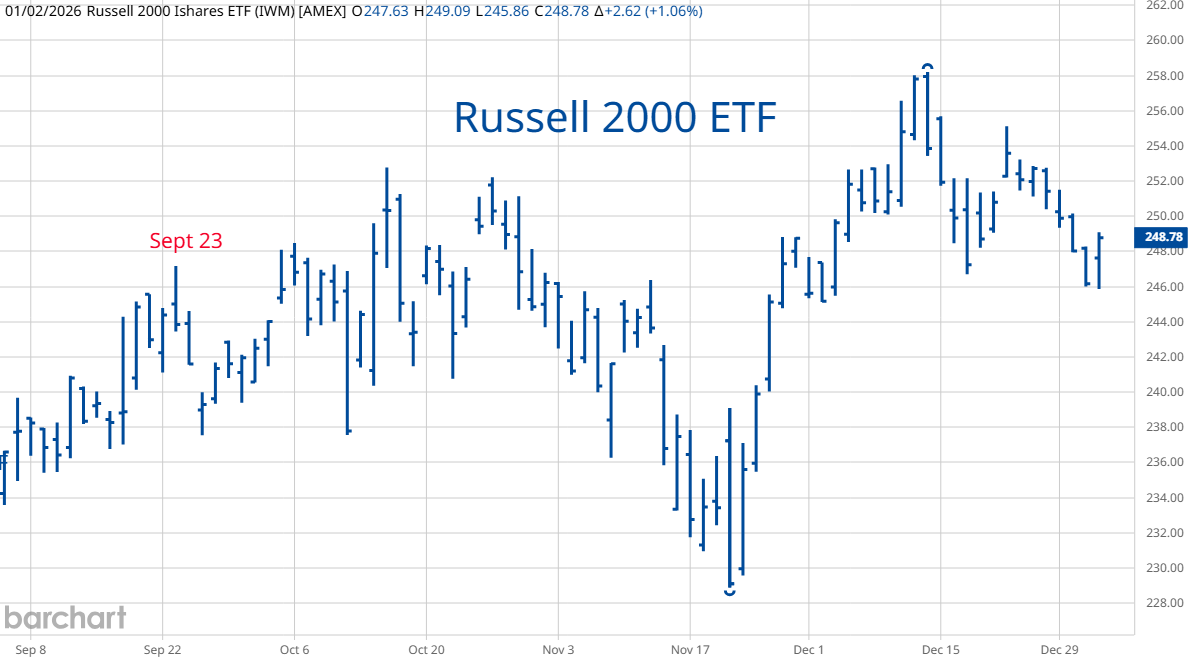

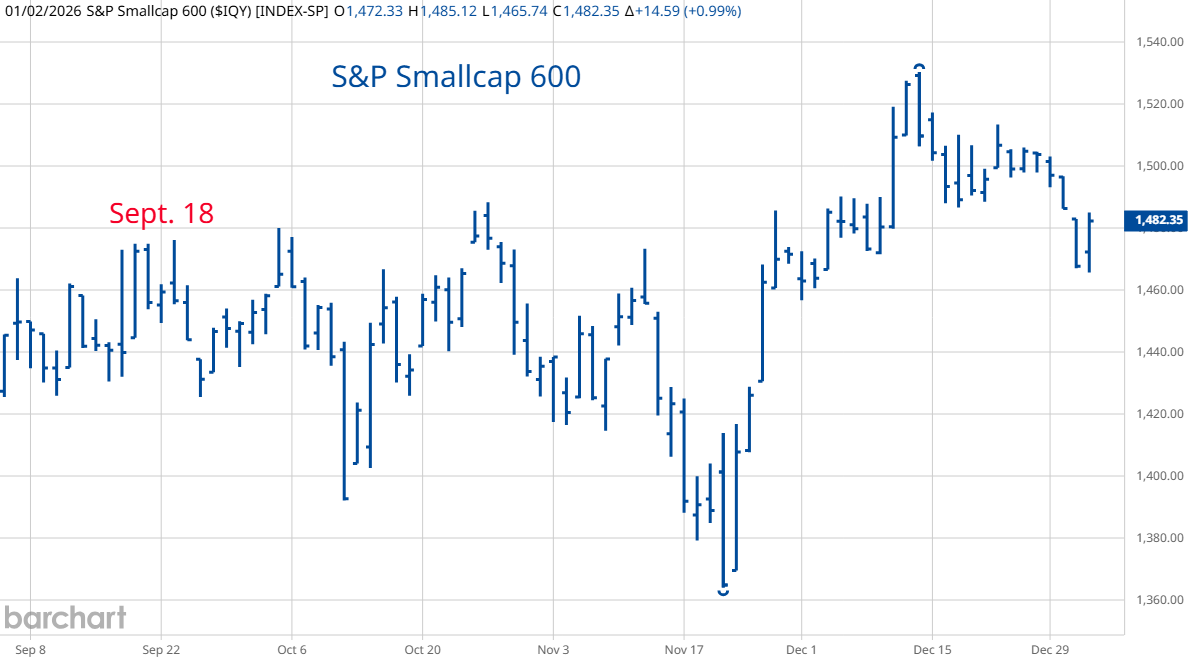

The NASDAQ 100 closed right around its high from Oct. 20th. The Russell 2000 hit a low on Friday morning that was within the range of where it traded on September 23rd. A lot of strategists are predicting a rotation away from the tech sector with the smaller, Russell 2000 companies doing better. It might happen in 2026 but has not happened yet.

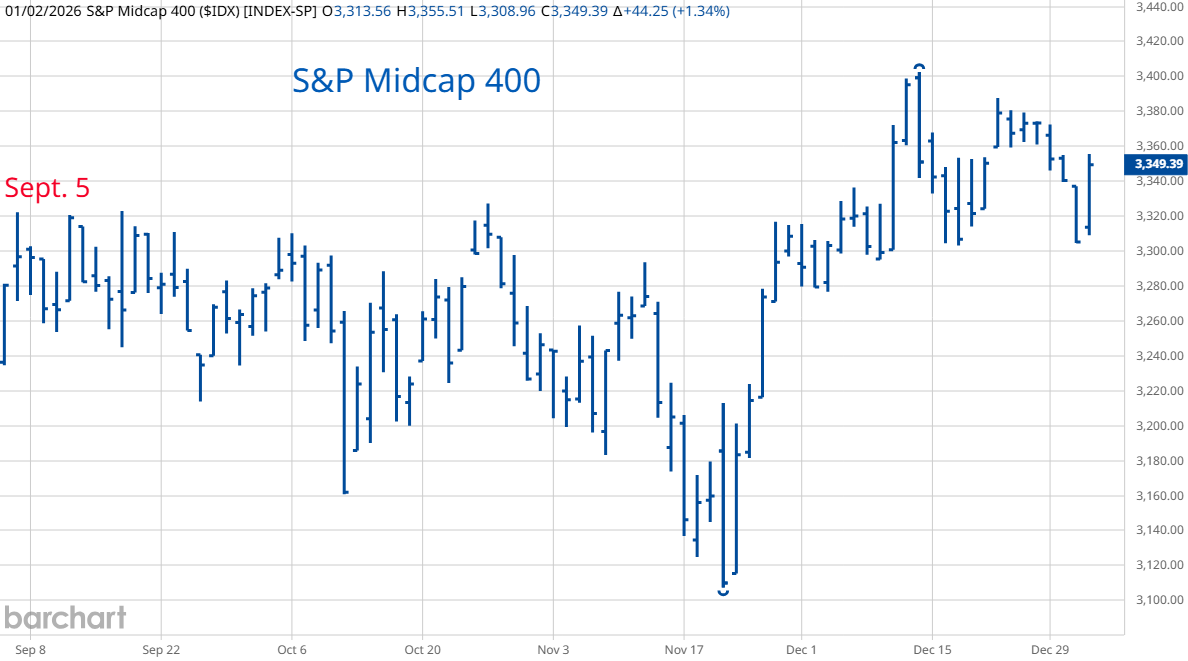

The rotation is also supposed to favor mid-cap and other small-cap shares. The theory is that these companies are more focused on the domestic economy and with the Trump administration's polices of protective tariffs and massive deficit spending aimed toward American industry, profits in these sectors will improve. It is possible but at Friday's lows, the bars on both of the S&P sector readings hit lows seen more than three months ago.

Prices for memory chips have been soaring this year. On Friday, an investor conference with Samsung highlighted this and memory chip makers gapped up at the opening, pushing SMH, the chip ETF to new highs. In past memory chip cycles, persistent price increases caused users to buy extra inventory to avoid future price increases. This resulted in fears of a shortage and even more buying and price hikes until, at some point, users realized that they had enough inventory. At that point, prices fell quickly. The blame for current demand goes to the build out of data centers. In past updates I warned that the current data center technology that uses exorbitant amounts of electricity and needs unrealistic amounts of clean water for cooling, is likely to be replaced. I mentioned competing wafers from Cerberus and Google's new TPU semiconductors that use much less electricity, water and space. On Friday, December 26th, Nvidia took over a chip design company Groq that is designing their own TPU type chip. It uses a fraction of the electricity and water that Nvidia's Blackwell based data centers will use and half the copper. Nvidia rallied last week on reports that Chinese companies are anxious to buy their H200 chips but the Chinese government has not approved these and just (Dec. 12th) introduced their own 70 billion Dollar plan to subsidies their domestic chip industry. I didn't hear a lot of commentary on the Groq transaction but it is immensely important. The more efficient chips are supposed to be available by 2027. If you are constructing a data center, do you build it with the current technology or wait for a year to build one with a fraction of the land and expenses for power, cooling and copper and with processors that are faster than the technology available today from Nvidia? Two years from now, data centers built with the old technology will be at a massive cost and performance disadvantage to those who wait. I was surprised that none of the analysts on TV were talking about this last week. Nvidia boasts a 45% profit margin on its current chips. When car dealers come out with new models for next year, how do they entice buyers to clear out their existing inventory? They cut prices. Given the new, much more efficient technology in the near future, how many data center plans will be quietly postponed? What does it mean for the future demand for copper, cooling equipment and everything else based on current data center design. When 2027 comes, there will be even more improvements that will need less energy, cooling and materials. The history of technology is that it is deflationary. Next year's innovation turns today's new products into relics.

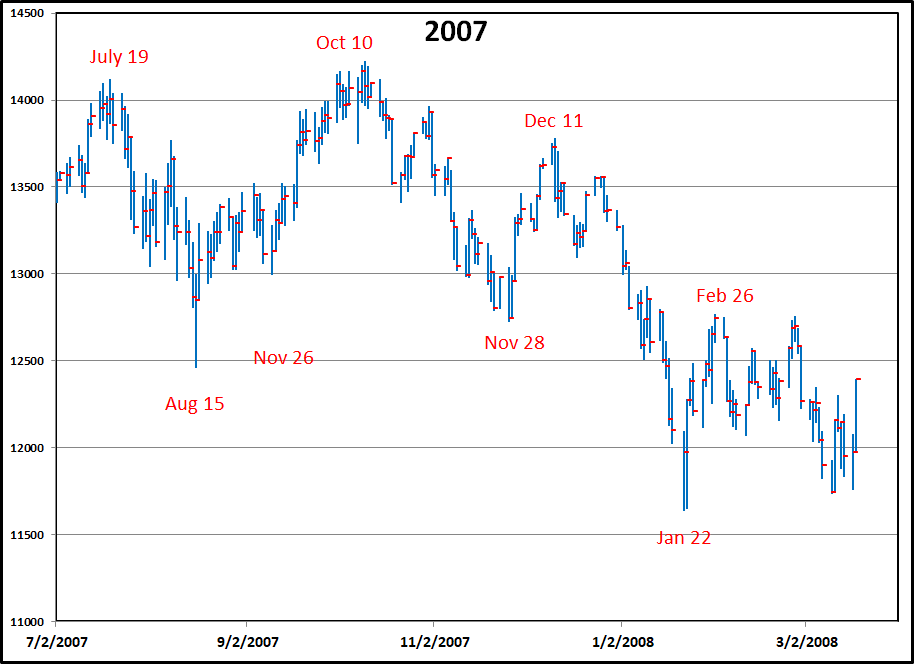

To the rightt is the 2007-2008 stock market. I included this chart in most of my recent updates because the price inflection points this year are coming around the same days as the ones in 2007. In early 2008, stocks fell into late January. Similarities in markets do not mean that the same thing "has to happen." How many articles start off with - "On Friday the market did something that led to gains 90% of the time in the past!" The availability of cheap cloud computing makes comparisons with previous markets and identification of seasonal patterns more available and popular. You can ask AI to identify the five periods that most closely track the last four months of trading and within an instant you have the results and can see what took place in the next month.

I believe that investors are increasingly trying to front run historical tendencies which makes using historical correlations less reliable and perhaps a money losing strategy. Once an indicator that worked well in the past becomes very popular, it can lose its efficacy. This is true for the 2007 - 2008 graph too.

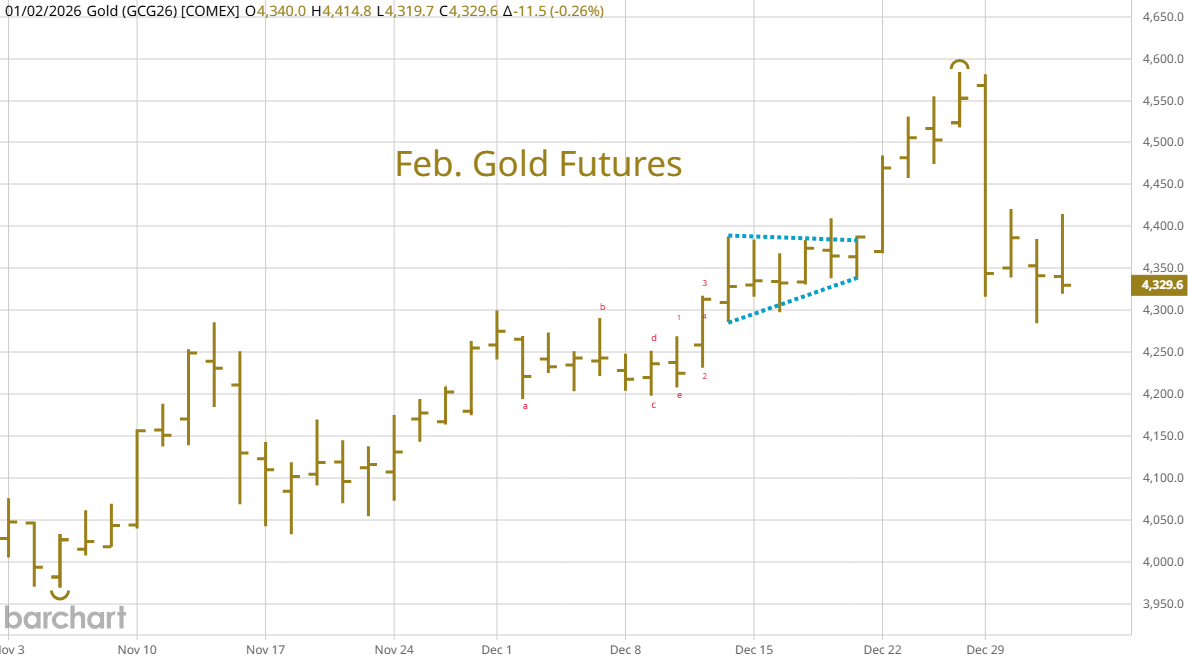

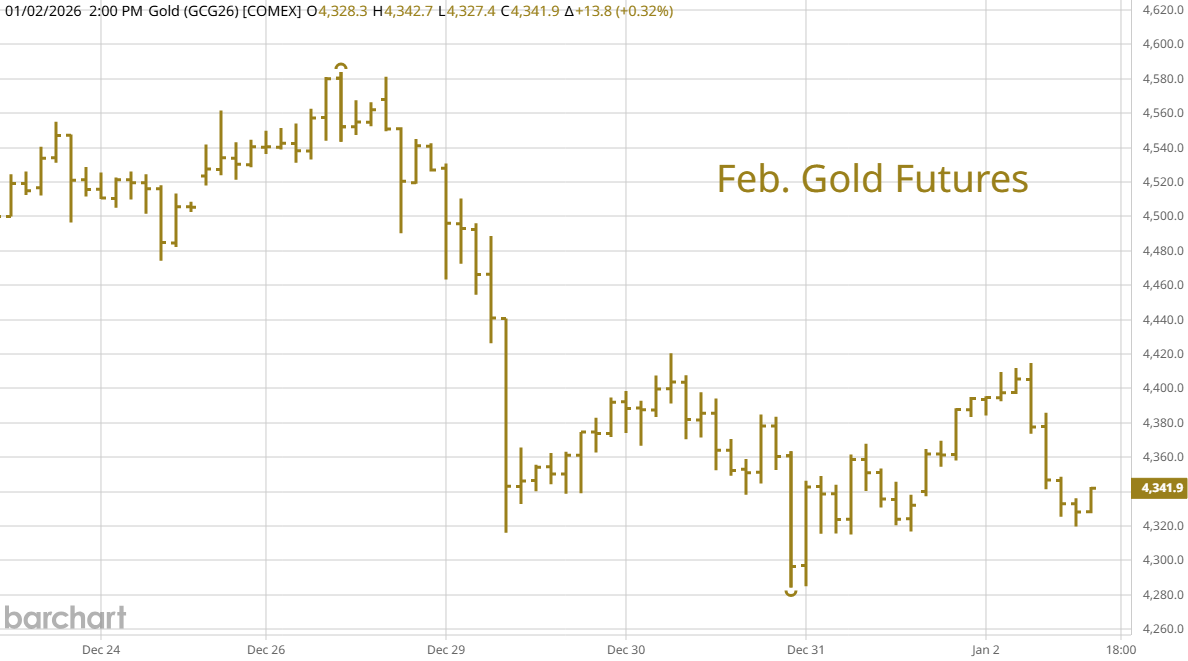

Gold fell, taking out a week's worth of prices. There are a lot of "swing" traders who see the violation of a previous week's trading range as a sell signal. On the right are two hour bars. Some are blaming a pending ceasefire in Ukraine and an increase in margin requirements for the selling. The failure to bounce a lot off of the low does not look good.

Above are the same time intervals for silver. It held up a bit better than gold but still closed near the lows of the last week. On the morning of its all time high, Zerohedge.com featured an article from a popular silver guru who wrote that silver's rapid 10% price increase implied much higher prices over the next few days. It was down more than $10 by the close. The next day there were no articles on what a dramatic drop implied for the future.

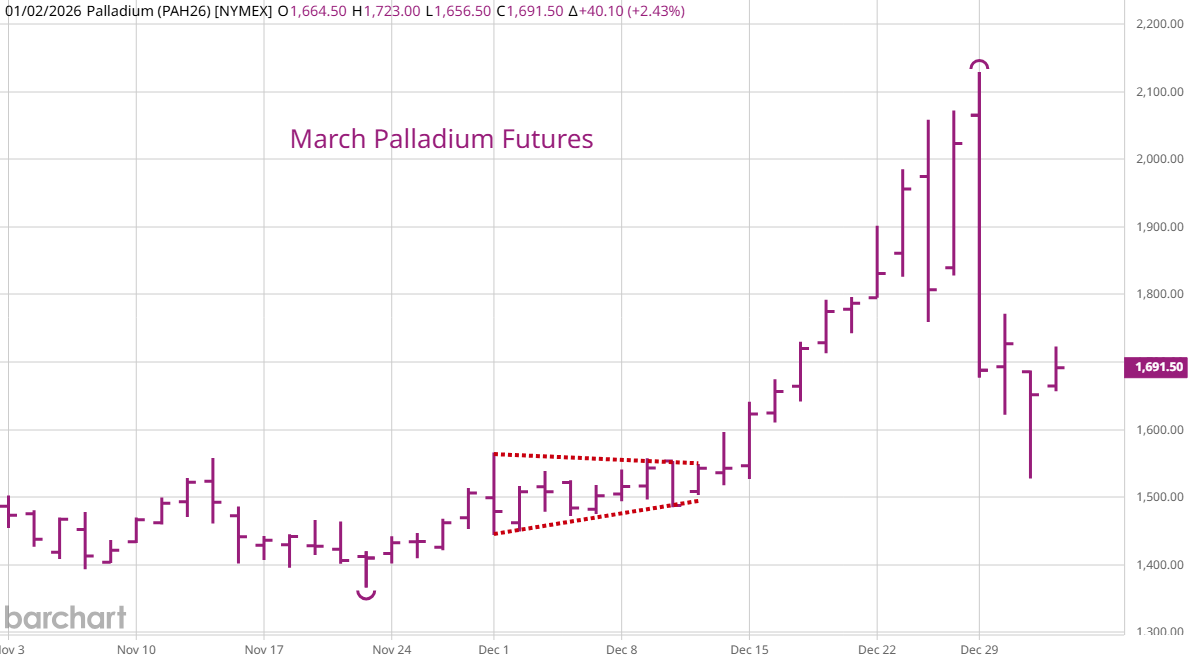

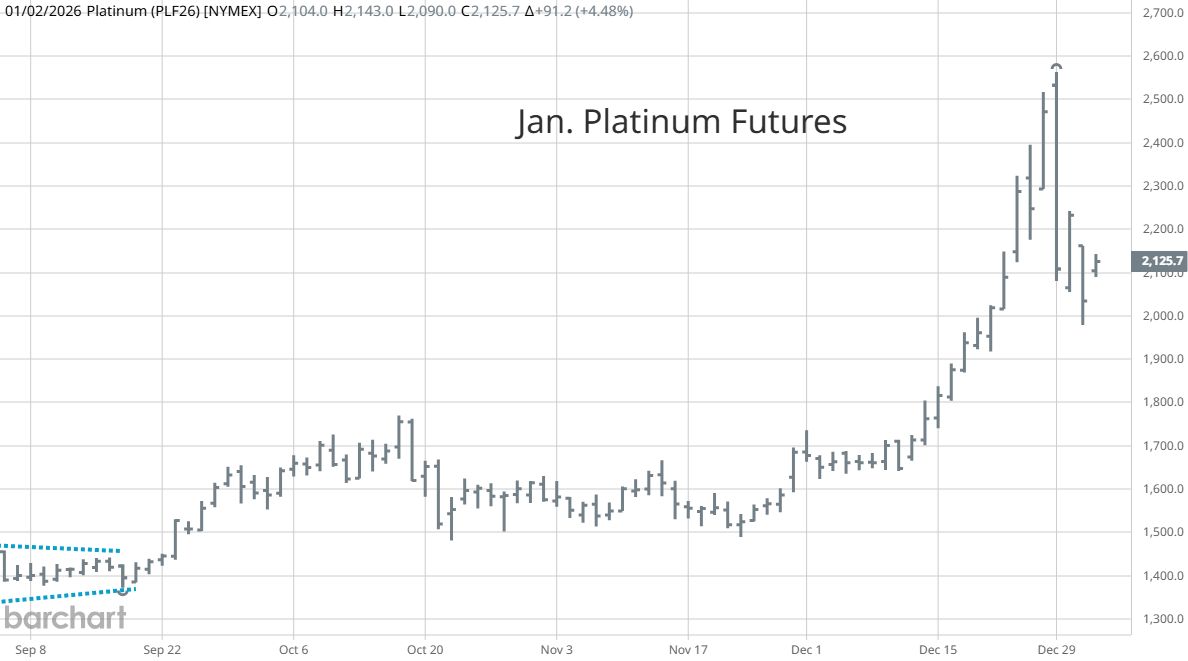

I like to think that platinum and palladium are things in themselves but they continue to follow gold on a daily basis. Last year I warned users to buy when no one cared about these metals. Mines were cutting back production due to low prices. On the demand side there were no new technologies that required much more of these metals that are primarily used for pollution control via catalytic converters and modifying hydrocarbon molecules in chemical reactions. In both cases, there is a high recycling rate. With spikes in prices, it is likely that mining companies are selling future contracts to allow them to ramp up production.

The U.S. price for copper spiked last summer due to tariff concerns. We are near those highs now. The story with copper is data center demand and the build out of more energy infrastructure that goes with the projected electricity needs from today's data center designs. What happens when the technology changes and much less electricity is needed to get the same results. Last week I saw another report on the use of lab grown brain cells for computing instead of massive data centers. The researchers say that these work just as well as massive data centers, using a very small space, very little electricity and minimum temperature control. Future technology improvements are not reflected in the prices of things assumed to benefit from current technology.

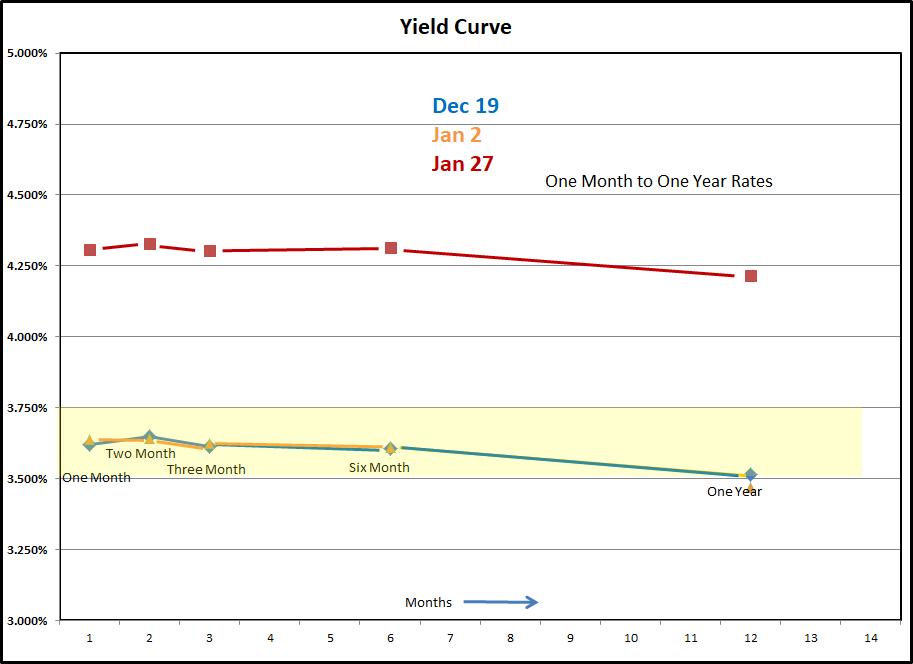

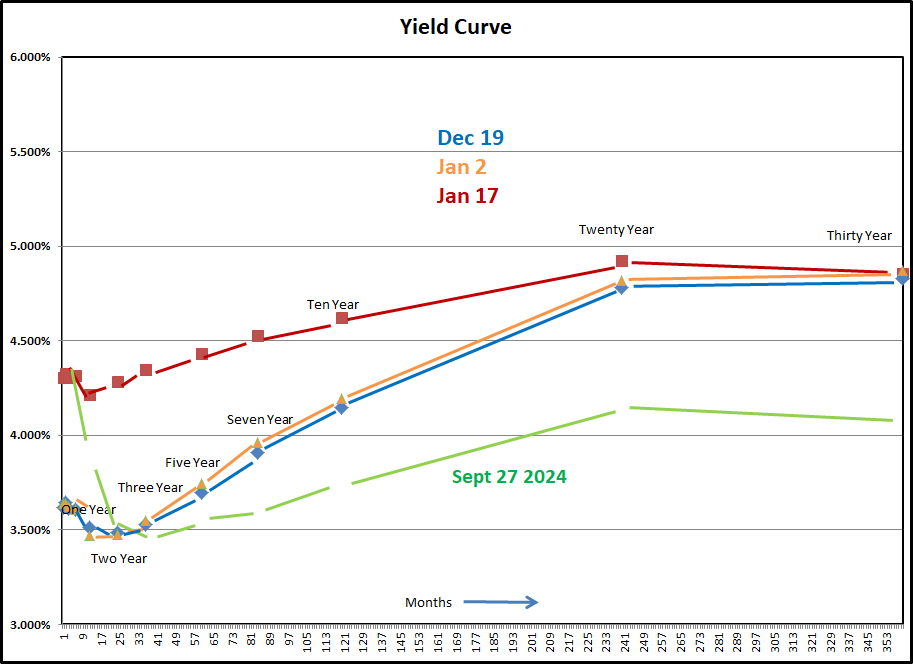

Above are the U.S. government debt yield curves. The orange line is this week's close. The left side graph shows the short end along with the target range of Fed Funds in yellow. The right side shows the longer end. Interest rates after two years in duration are higher. In the financial press there are questions about just why the Fed lowered rates in December. If we get a big increase in New Claims for Unemployment Benefits, the narrative will flip toward more rate cuts.

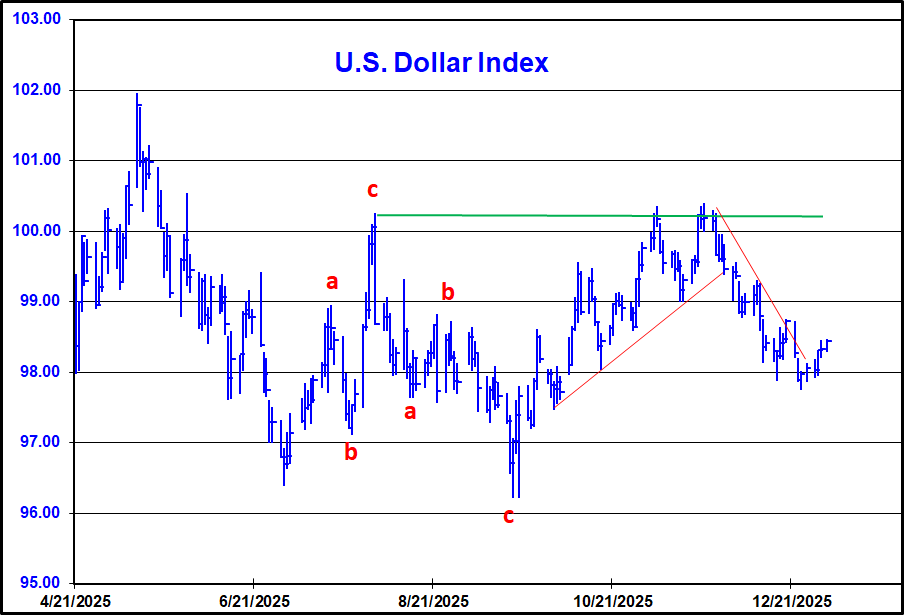

The Dollar refuses to die. The sideways trading range still looks like a correction before another decline but the late December low held well above the fall low. Currency trends often take place at the end of the year. The action in Venezuela should benefit the Dollar. If a Pro-U.S. group replaces Maduro it means work for U.S. companies, more oil supply and less in military expenditures to defend against a hostile actor just a few hours by air from Miami. We need a move above the green horizontal line on the left side graph to feel better about the Dollar.

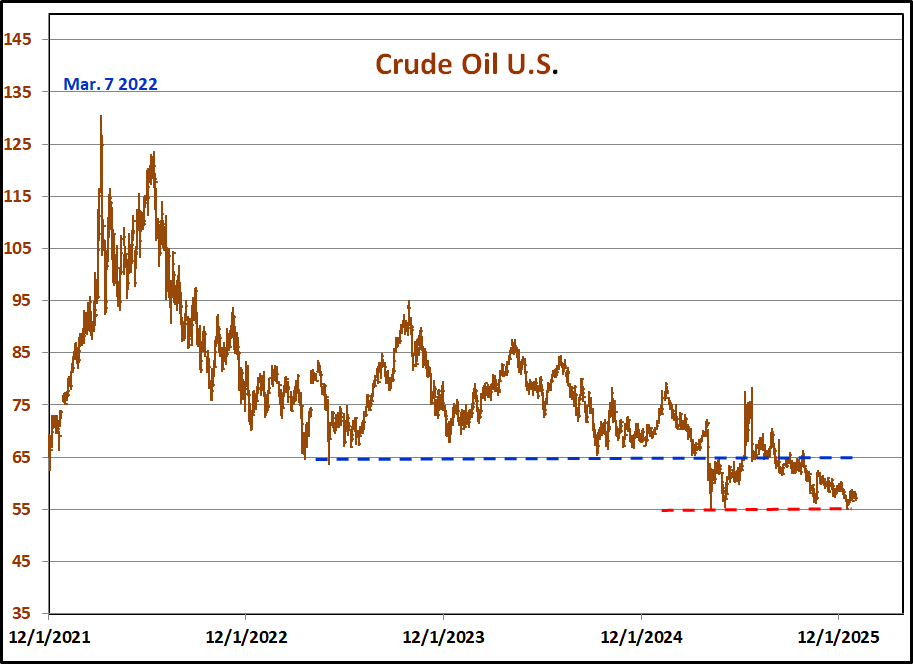

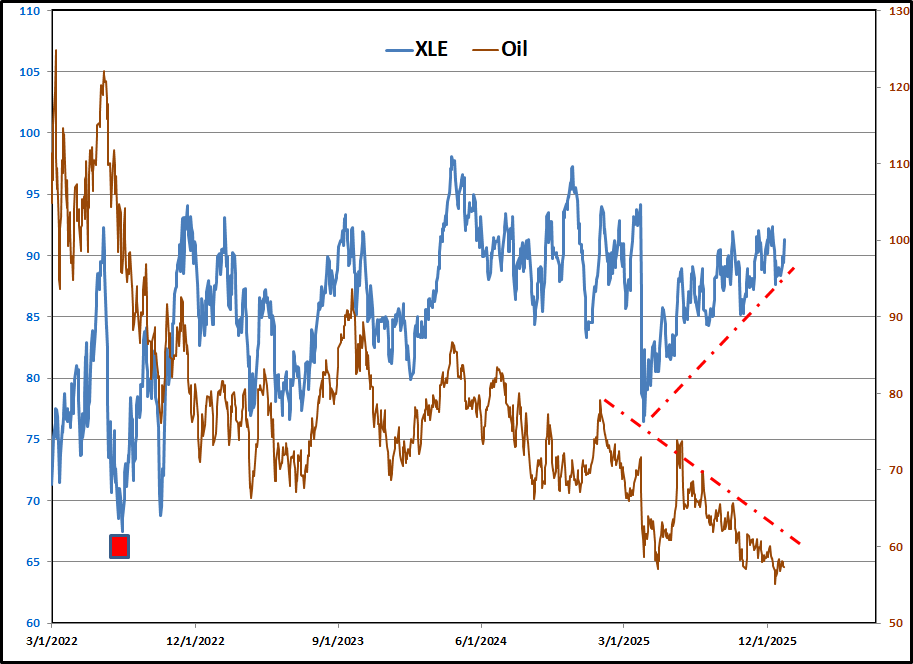

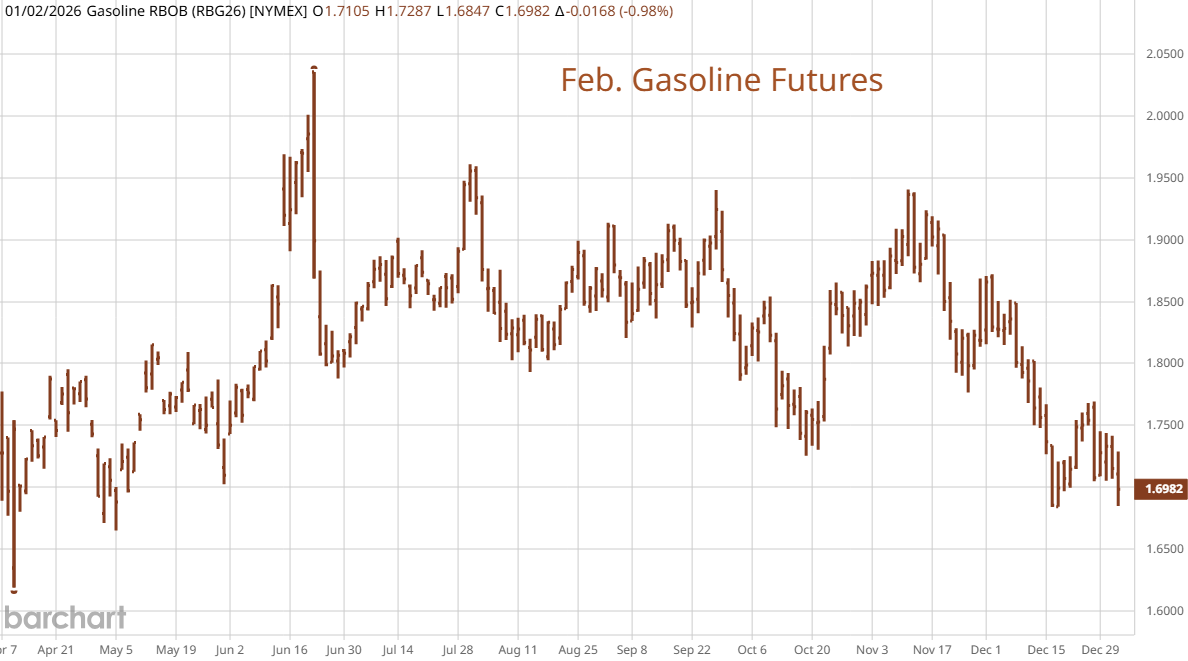

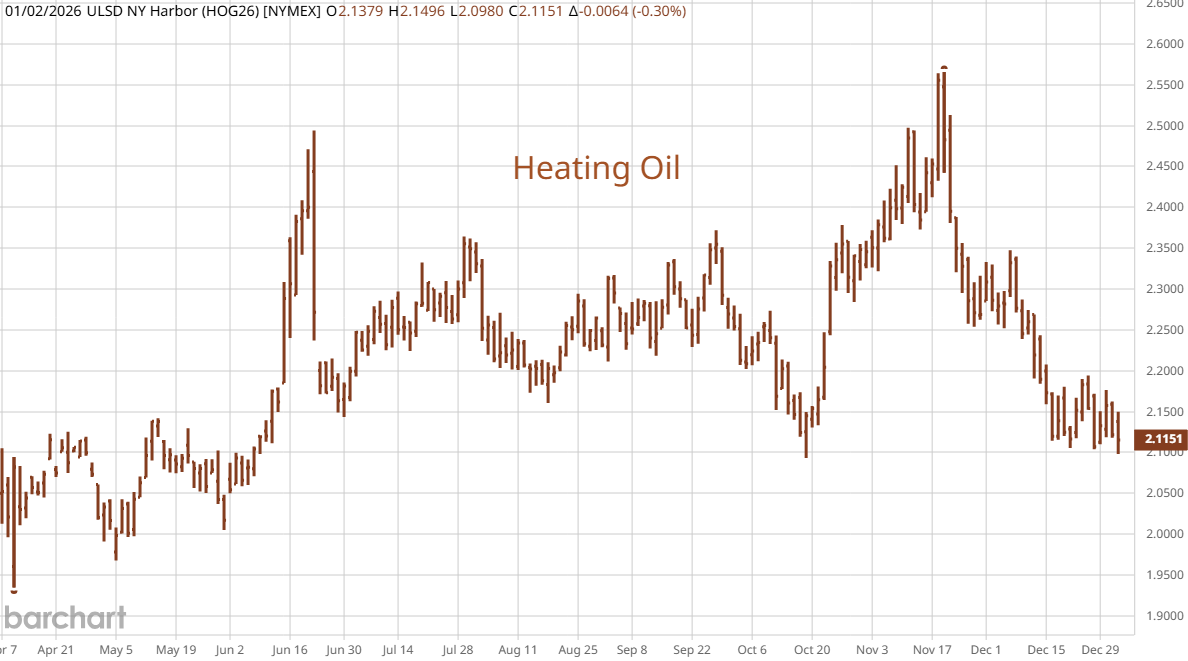

With regime change in Venezuela, what will happen to energy prices? Will we see a sell-off on Sunday night or will markets believe that more Venezuelan oil is already priced in to the market? Ukraine and Russia seem close to some kind of agreement. Will more Russian energy flow to the rest of the world within a few months? The upper right graph shows XLE, the big energy company ETF and the price of oil. I did not adjust the price graph for the recent 2 for one split in XLE. The red square marks a price point for XLE when oil was trading in the 90s. How are lower energy prices good for oil companies? Some of the majors might eventually make money by investing in Venezuela but they will have to spend billions of Dollars to upgrade the infrastructure. Every hedge-fund manager I hear interviewed recommends energy as the next big play. This might be tested next week.

Above are two popular Commodity ETFs. DBC's basket is more oriented toward agricultural commodities. GSG is more heavily weighted to energy. Both fell toward their 200 day moving averages last week. Every analyst I listen to is predicting higher prices for commodities next year based on Fed easy money and huge fiscal stimulus from governments all over the world. A break of the 200 day moving average will go against the thoughts of the best and brightest and tell us that despite all the borrowed money injected in the world's economy, demand for "things" is not getting better.

Best Guesses -

Stocks - I was cautious last time and still am going into the new year. The Santa Clause rally didn't work out well. January is supposed to be one of the best months for equity inflows. I will sit and watch.

Bonds - Short term rate cuts are still not spreading into longer term rates. We need to see definitive signs of a slowing economy or a stock market sell off that is frightening enough to cause a flight toward safety into longer dated fixed income.

Dollar - It just won't die and a successful change of leadership in Venezuela should help the Dollar.

Gold and Silver - Margins increase when the big trading houses see huge bets on one side of a market. Everyone in the commodities business for more than a decade witnessed a particular item that captured traders imaginations and sucked in a huge following followed by a crash. Trading firms know that when this happens, a certain percentage of players are unable to meet margin calls. Their positions are liquidated at a loss and lawyers are hired to try and collect. Often, the trading houses are forced to settle for a partial payment. The actual increases were not that much per contract but prices were extremely extended and due for a pull back. I will sit and watch for a while.

Commodities - The anticipated rally in most commodities is not happening. Watch the 200 day moving average in DBC and GSG. War is traditionally good for commodities. With peace temporarily breaking out here and there, war trades will liquidate. The new chip technology needs much less energy and half the copper that is being used now. Once this sinks in you should see it reflected in prices.

Oil - We are in a "war vs glut" kind of market and the peace narrative is winning out for now.

Question of the week - Will Russia and China fund an insurgency in Venezuela that destroys oil infrastructure improvements and drags the U.S. into a Vietnam type situation?

Best of luck,

DBE