Following are my personal comments on specific markets and issues. I chart markets for a hobby and my comments are the result. They are not recommendations to buy or sell anything and should not be thought of as such. They are for entertainment purposes only so enjoy.

David Bruce Edwards

Feb. 28th, 2026

Please remember, the following is pure speculation based only on my experience and chart patterns. "Every sunken ship has a room full of charts."

Note - I got a new wider screen monitor and when I look at this web site with the screen size in full, the site spacing does not come out properly. By making the window less wide all of the text and graphics slide into place. Perhaps you are having the same experience. DBE.

As usual, I will show pictures and graphs found on Zerohedge.com, Sentimentrader.com, which include the Seasonality charts and charts made on Barchart.com. I will also mention "cycle low timing bands" suggested by another market website to which I subscribe, Cyclesman.com.

Regular readers know that I have been cautious on the stock market. Aside from the chart patterns and overwhelmingly bullish commentary, seasonality also influenced my thinking. The period between the third week of February and second week of March is often a weak time for stocks. Economic statistics from the last two weeks were mostly indicative of a strong economy but, as we often see, the stock market and the economy are different.

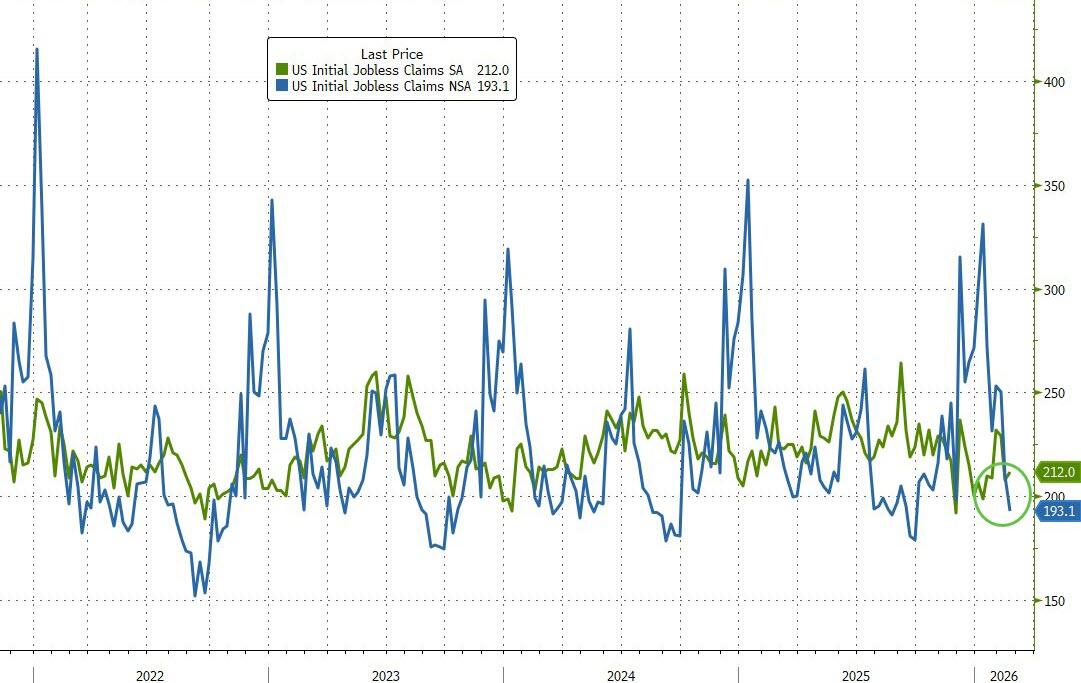

New Claims for Unemployment Benefits came in near the bottom of their recent range at 212,000 (left side green line). A couple of weeks ago there was a big spike up in the unadjusted number. This week it went in the other direction (blue line). Continuing claims (right side, red line) fell again and the four week average of new claims was flat. If AI is killing jobs, we are not seeing it in New Claims for Unemployment Benefits.

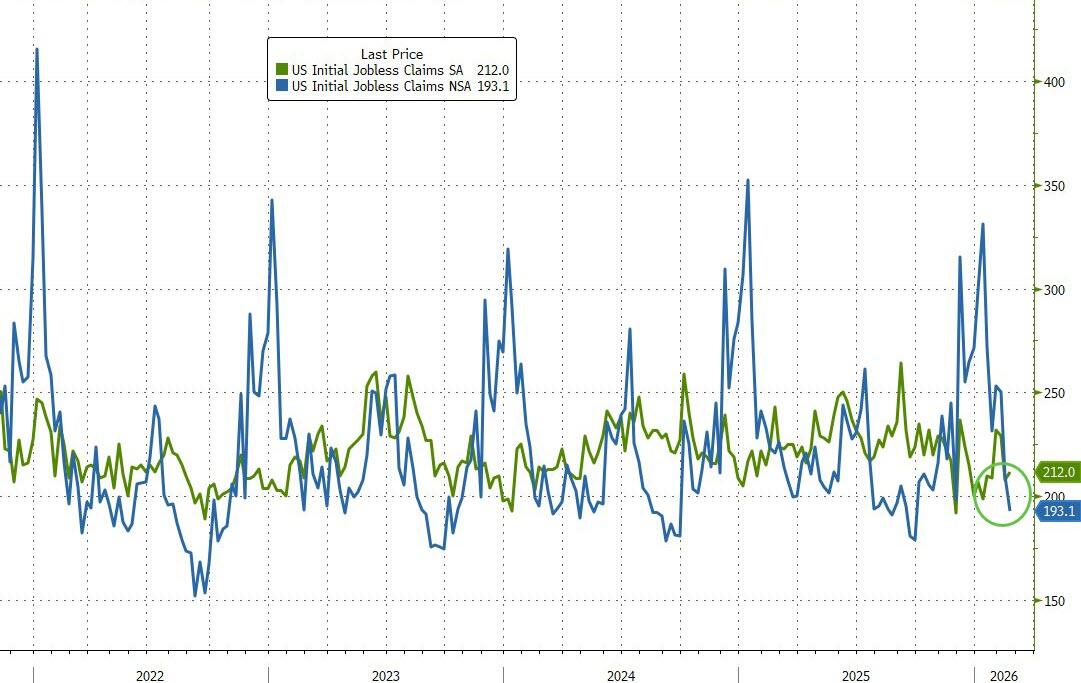

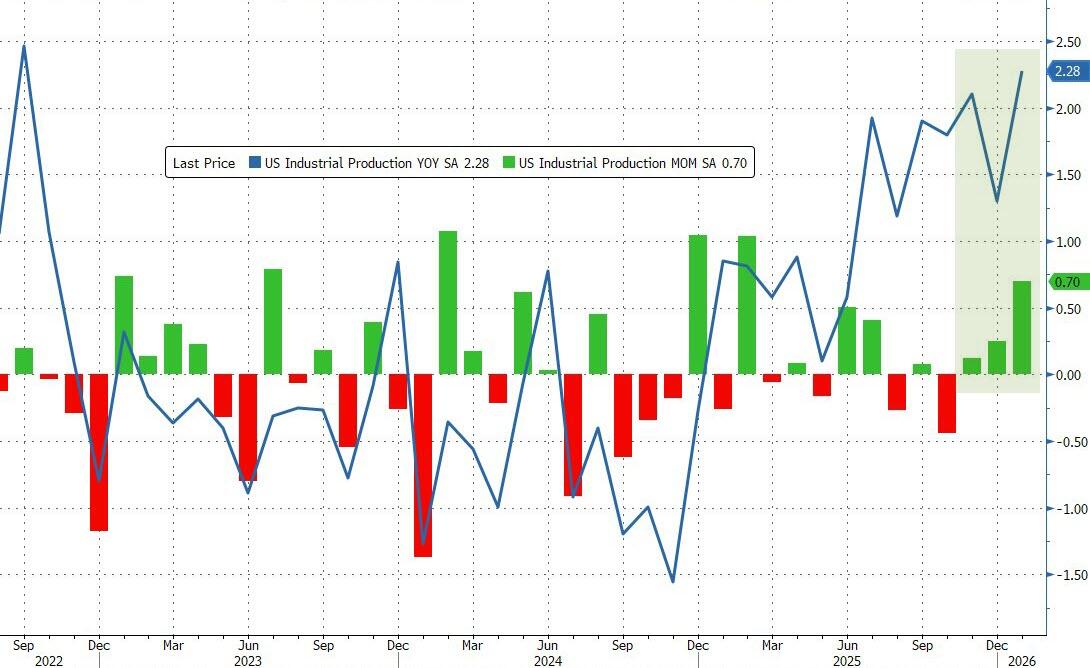

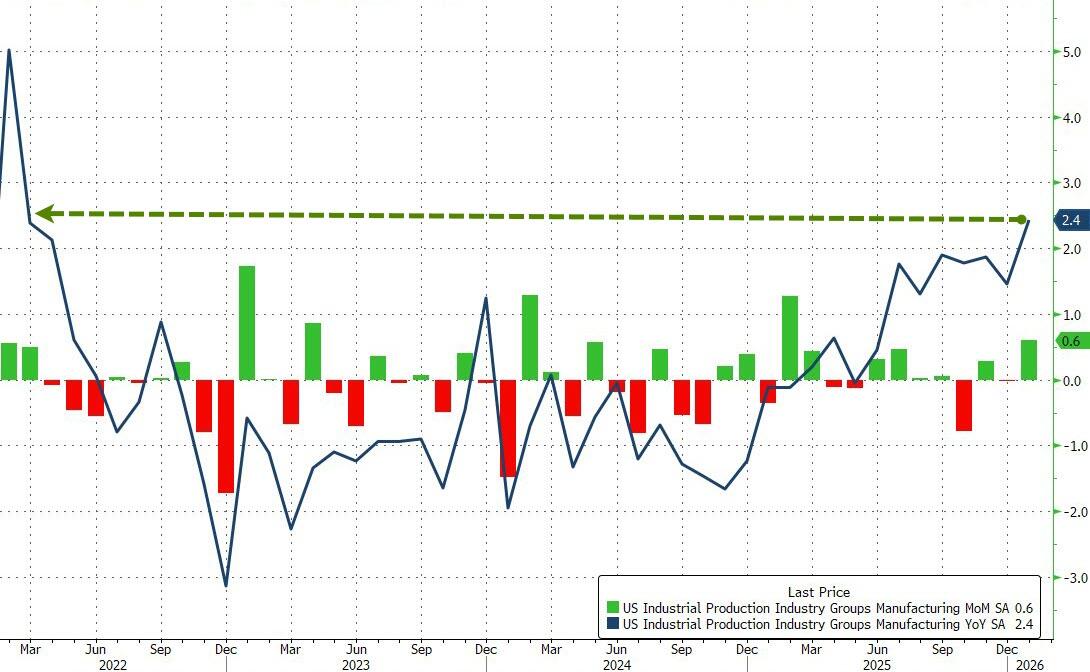

January Industrial Production (left) rose 0.70% month over month and 2.8% year over year. This is the best reading since the fall of 2022. Manufacturing Output (upper right) also showed a healthy gain

Capacity Utilization rose too (right). Governments all over the world are borrowing huge sums of money and injecting it directly into their industries. In the U.S. we have laws that allow quick write offs for expenditures and new equipment. Given this worldwide push to expand manufacturing, it would be surprising if we did not see improvements in these numbers. We have to remember that it is being driven by debt fueled spending and speculative investment in data centers.

A friend of mine in the construction business once said, "You can always get a loan to build something. Making enough to pay it back is the hard part."

Building Permits (left side, blue line) and housing starts (green line) were both up. The gains were lopsidedly in multi-family units. Single family houses were down. The right side graph shows total homes sold with the most recent data point from last fall(green line). The yellow and red lines show total existing home sales and pending home sales. Both data sets are near the low end of their ranges. New homes are moving faster than existing homes because home builders are offering big concessions to attract buyers. Sellers of existing homes are still trying to get high prices for their properties. On Friday, the rate on a ten year T Note dropped below 4% so mortgage rates should be down next week. Will fresh demand result in more sales or will sellers just increase prices when they see more buyers showing up?

On the left are survey results from purchasing managers for services (green) and manufacturing (blue). Both fell last month. The red line tracks hard data as opposed to surveys. The Hard series rose steadily last year. Now it is falling. On the right is graph tracking the price index for Personal Consumption. It was hotter than expected last month, rising 0.4% with the annual reading at 2.9%. This is the highest in a year which is not a good sign for those looking for the Fed to cut overnight lending rates.

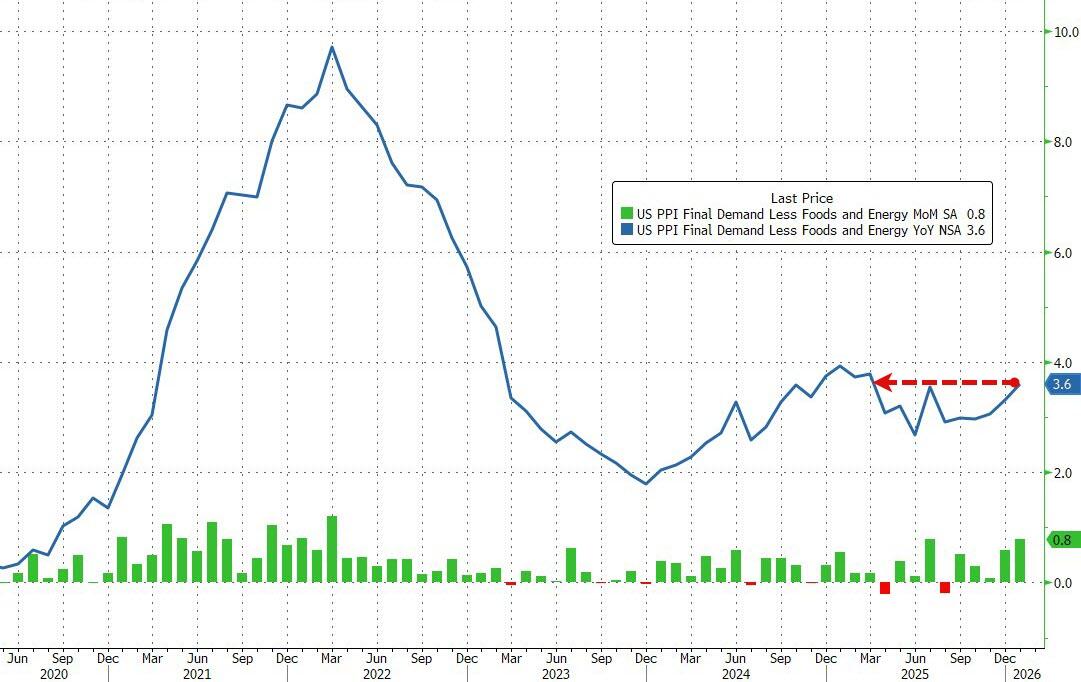

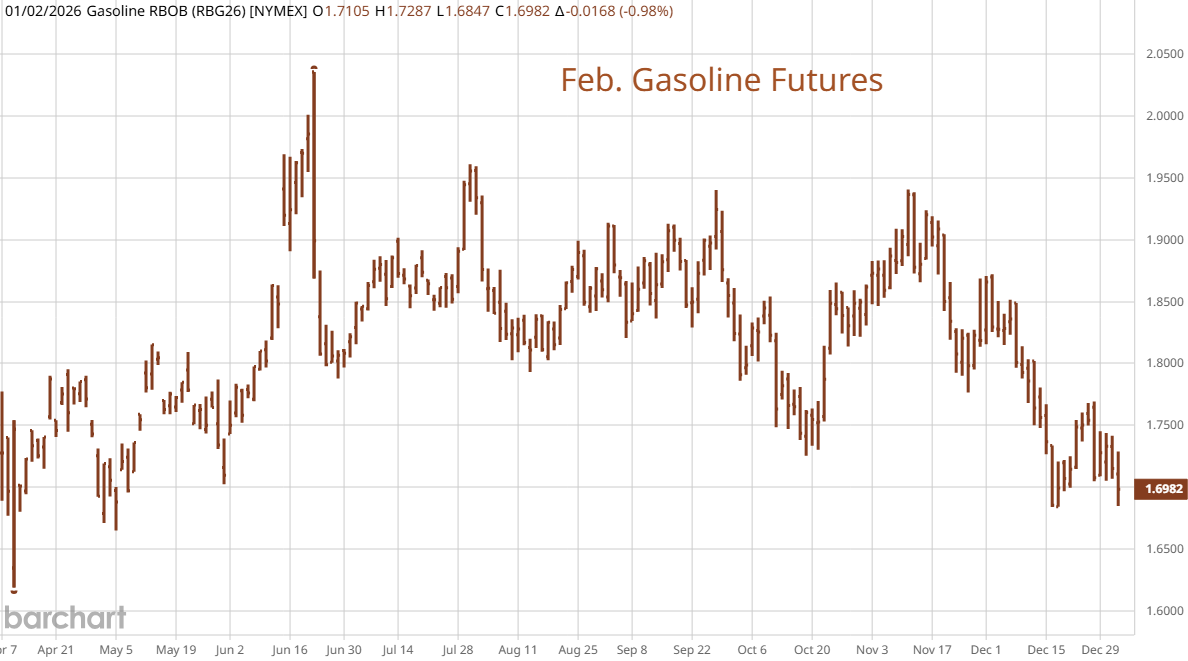

On Friday we got January Producer Prices, a reading of wholesale inflation. The upper left graph shows the headline number. The right side shows Core Producer Prices which subtract food and energy. Both sets of data came in much hotter than analysts expected. The headline number was lower than the core reading due to lower gasoline prices. Directly to the left is a graph of April Gasoline futures and you can see what happened since this survey was taken! The year over year reading on the core number is 3.6%. A Wall Street narrative is that inflation is under control and will gradually fall toward 2%. The PPI data goes against this.The big increase came from the costs for machinery and other industrial goods. All the government and data center spending is allowing vendors to jack up prices.

With Producer Prices rising faster than Consumer prices, profit margins should be down.

The markets are trying to price a mixture of news and potential outcomes. These include:

1. A military strike on Iran. Late Friday, reports said that Iran agreed to dilute its weapons grade uranium and allow interntional inspectors into its facilities. As I type early Saturday morning, we are attacking Iran. Our planners envision some kind of lighting strike that results in quick capitulation but Iran is responding with missiles and drones. What if one of them damages or sinks a large U.S. ship and kills hundreds of sailors? Will they be able to mine the Straits of Hormuz and stop oil shipments? Will they attack oil refining and exporting facilities in neighboring states? Will Russia or China come to their rescue? Once war begins, outcomes are a matter of probability and never a sure thing. Anxiety over Iran is showing up in energy markets and precious metals.

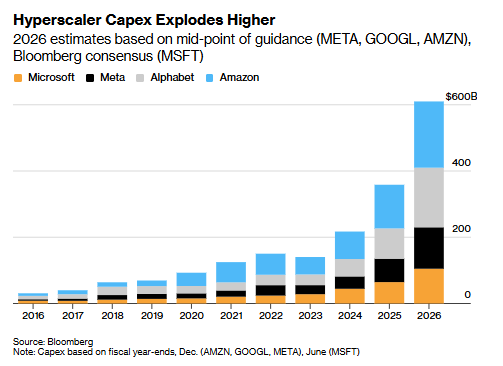

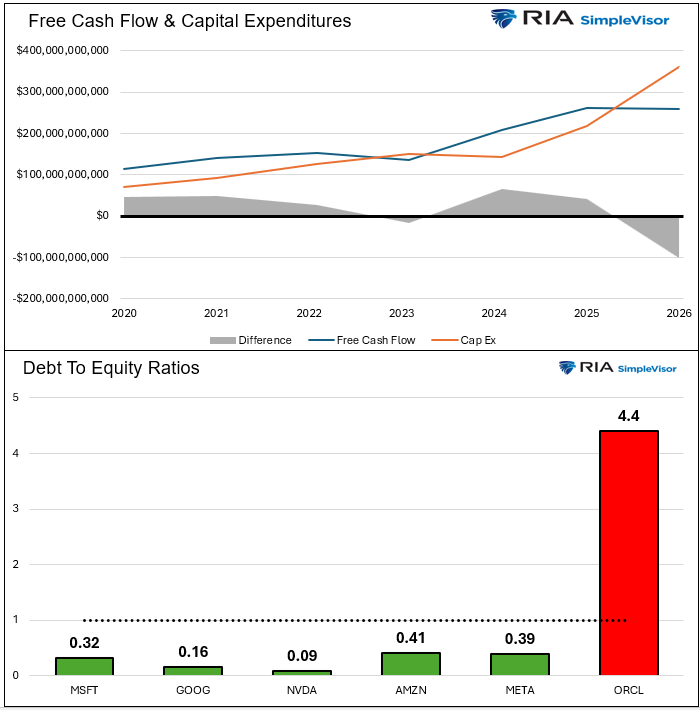

2. AI. There are two issues. A) Anthropic in particular is focusing on AI that can inexpensively create software for your business that you are currently buying from outside companies. Supporters of AI say that even if the current AI driven solutions are not as good as the ones you have to pay for, the will be in the near future and this will lower the prices for vendors of all kinds of services. Critics of AI say that AI software is trash compared to current SAP or Microsoft offerings and will never be as good. B) Trillions of Dollars are being spent to build data centers all over the world but it is difficult to envision a scenario where the cash flow from selling AI to consumers will be able to cover the costs of the build out. Hyperscalers like Google, Meta and Amazon are used to having near monopolies on certain businesses. Their spending on AI anticipates a future monopoly scenario where they put competitors out of business and the world has to come to them. But, it is likely that there will be international competition for AI services from China and eventually, India. Competition means lower prices. AI fans say that "AI adoption" is happening quickly and is resulting in a productivity revolution. AI skeptics point to recent surveys of corporate executives who say that they are slowing their spending on AI because they are not seeing results that add to their profits.

3. Big Problems with Private Credit. Last week, MFS, a huge mortgage lending company in the United Kingdoom collapsed with billions of Dollars disappearing. The rumor is that they used the same properties as collateral for multiple loans. Major banks and private credit lendors are looking at losses. This is the latest blow to Private Credit and confidence in general by complacent lenders. Blue Owl, a big private credit company in NY stopped redemptions in some of its funds. Last week, Wall St. sent multiple defenders of Private Credit to the financial networks to tell investors that the industry is secure and their money is safe. This did little to calm nerves.

Traders need to remember that there is always some good news and bad news available. Near market peaks, everyone focuses on the good news. At lows, bad news takes center stage. As pessimism builds, so does the probability of a tradable low. Late February and early March were decent times to buy in some years.

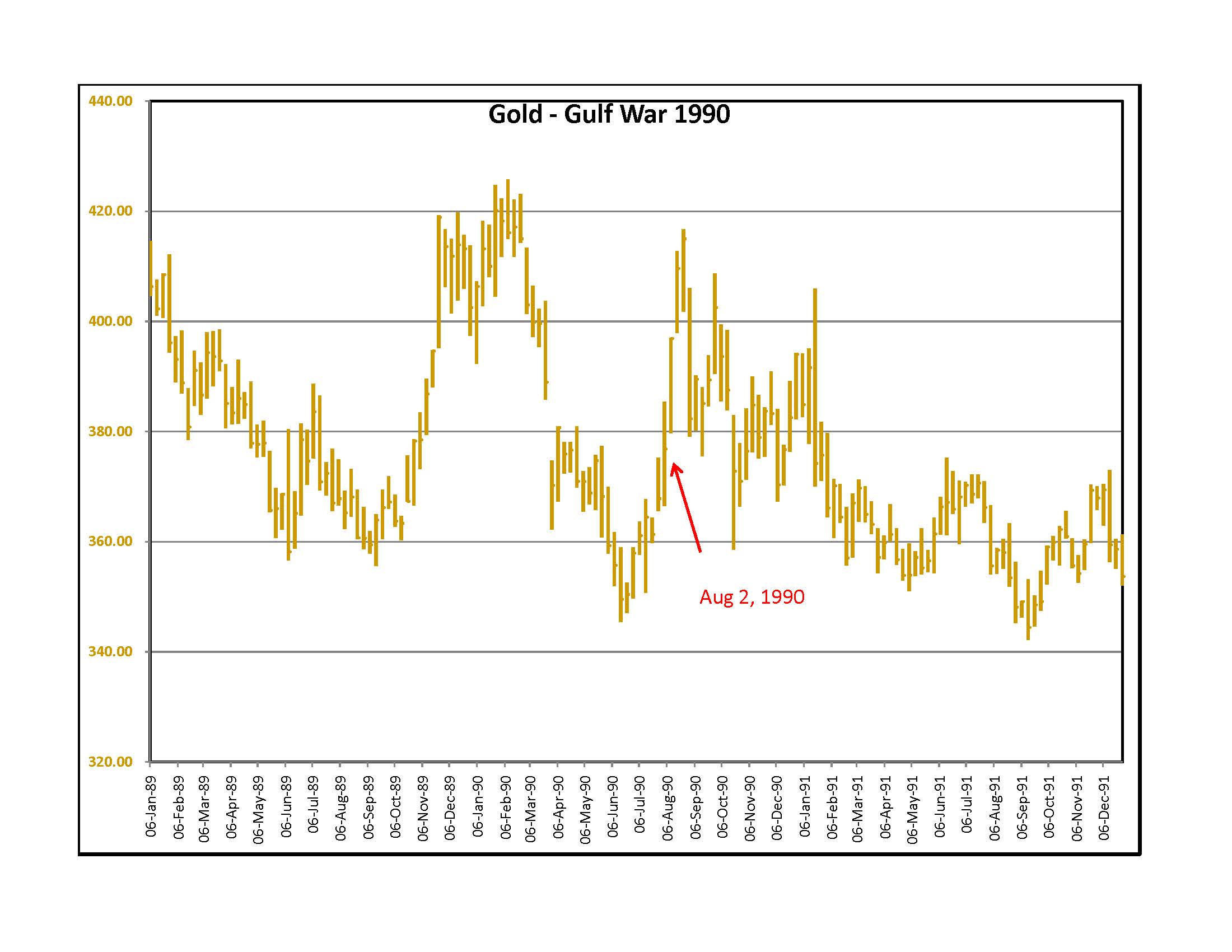

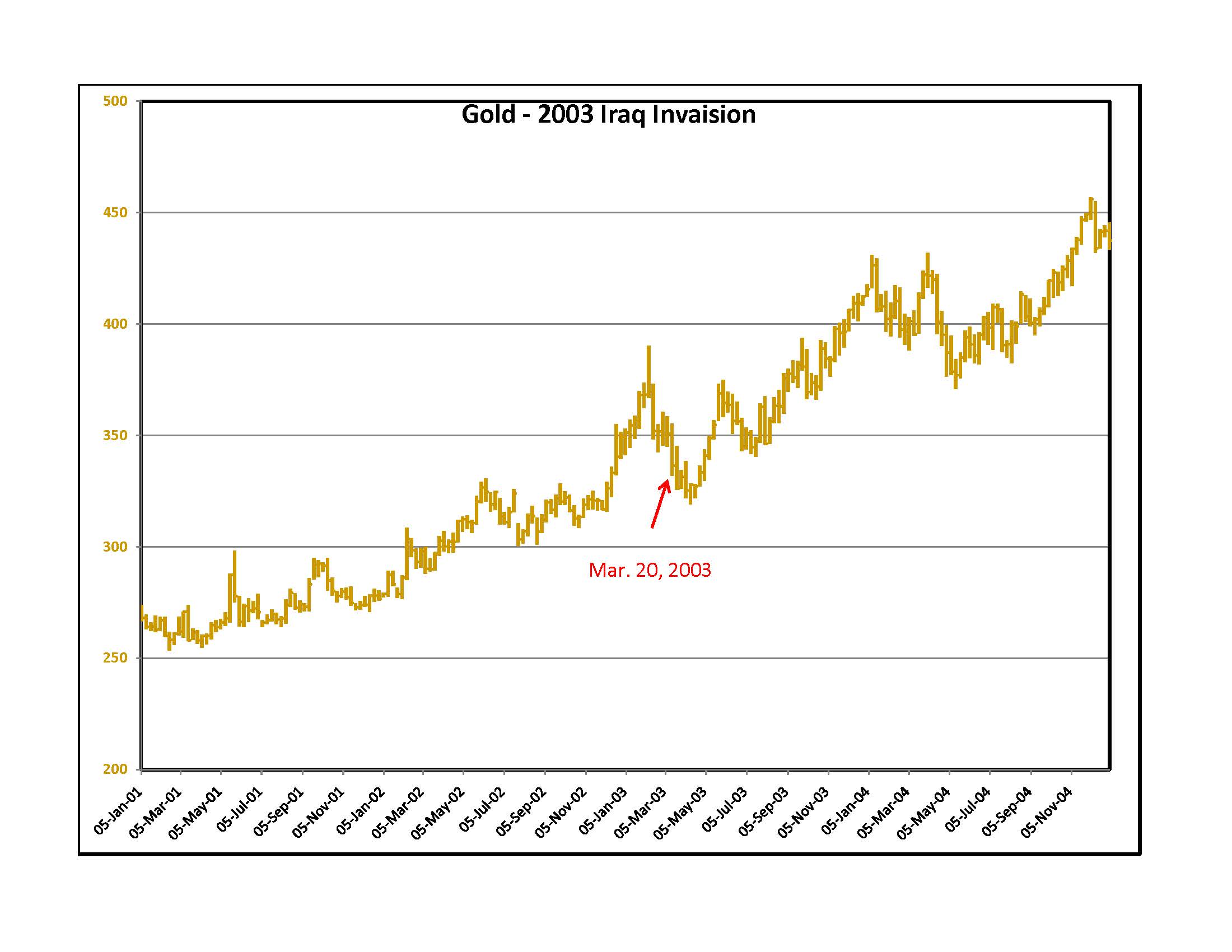

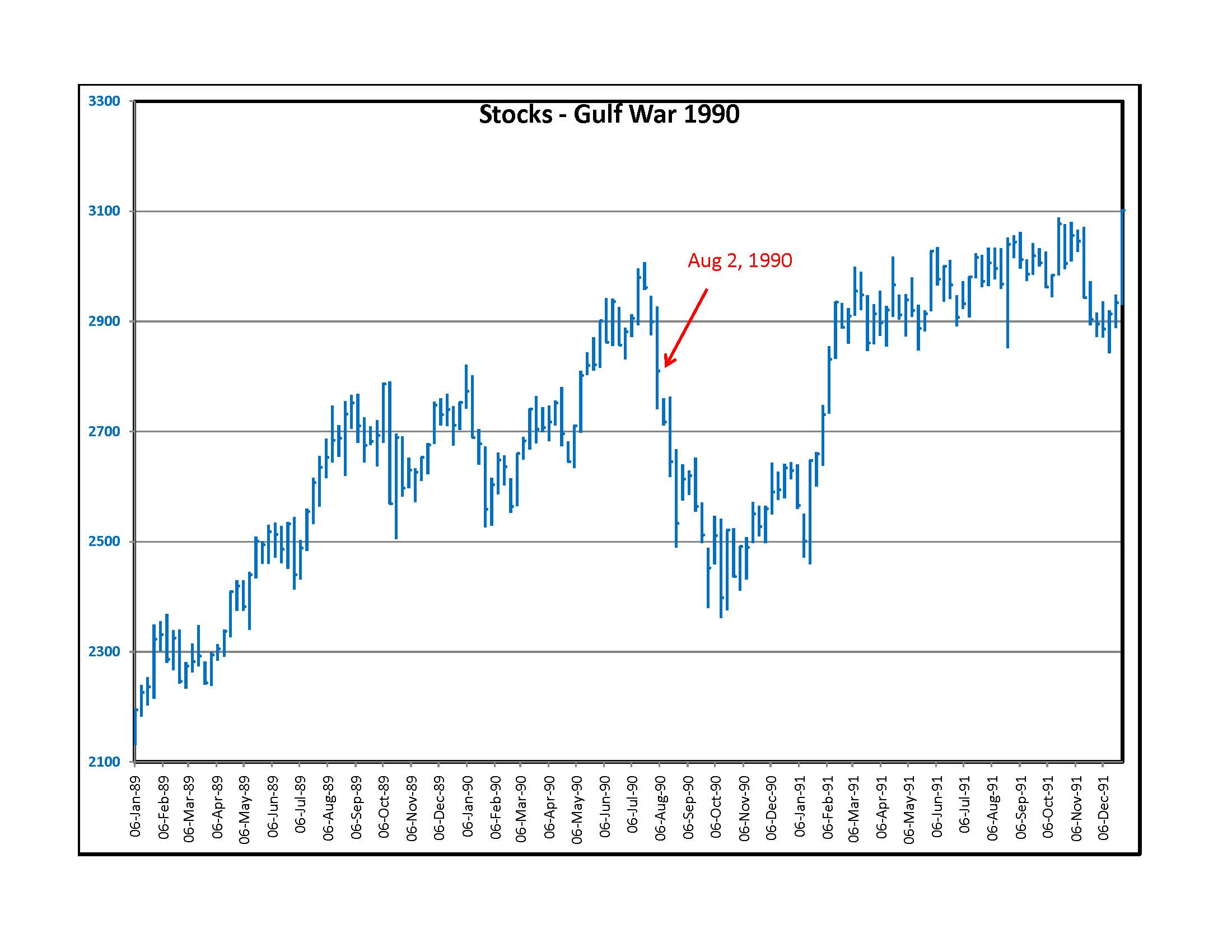

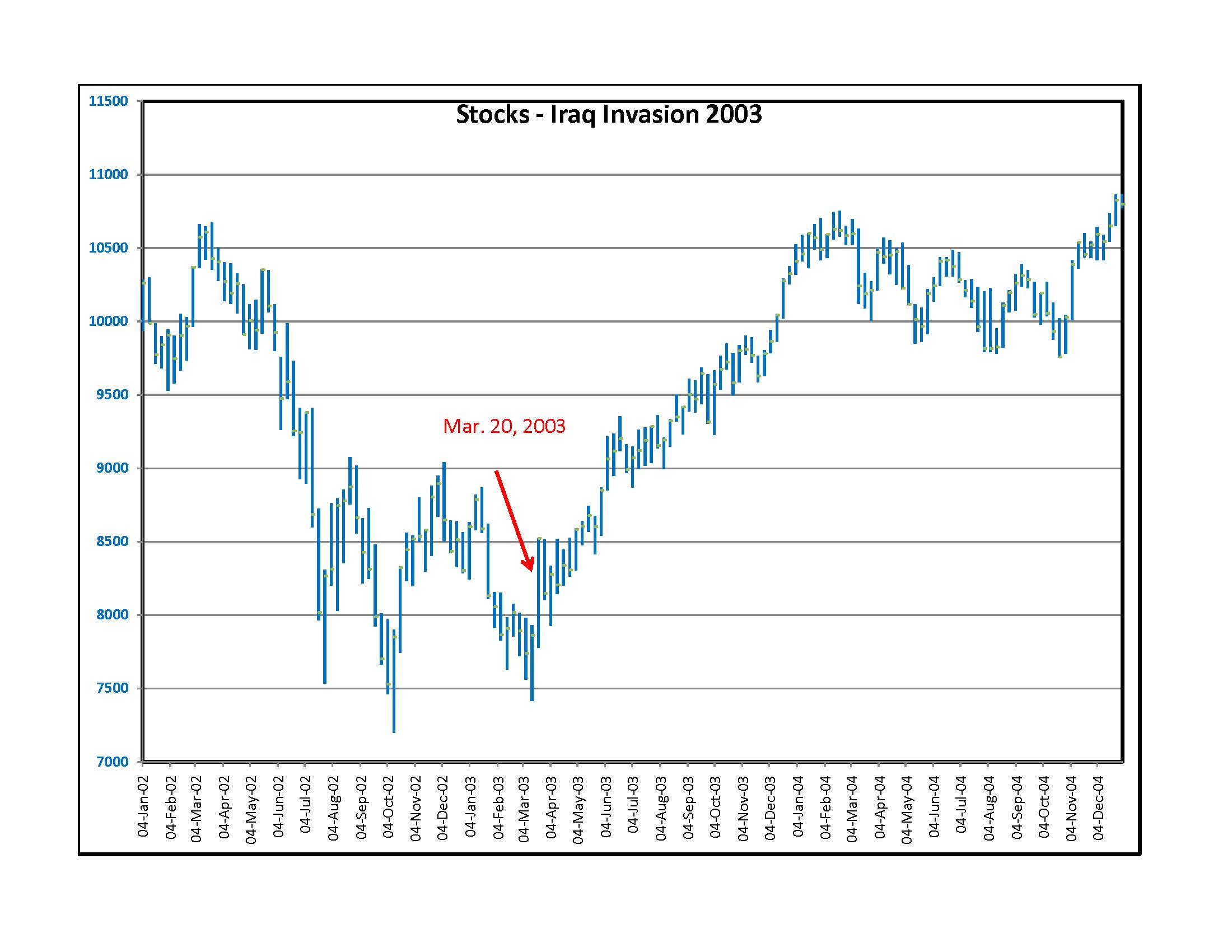

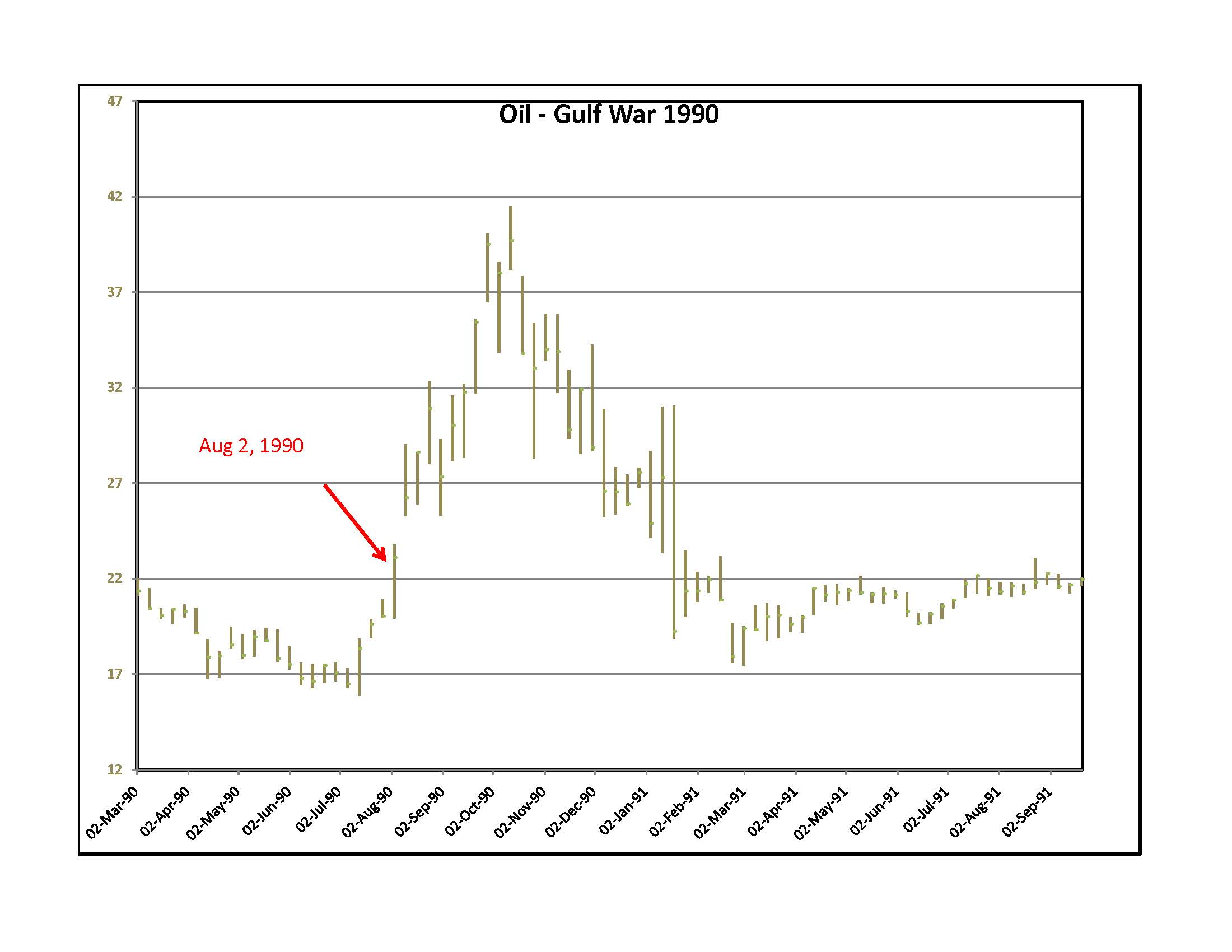

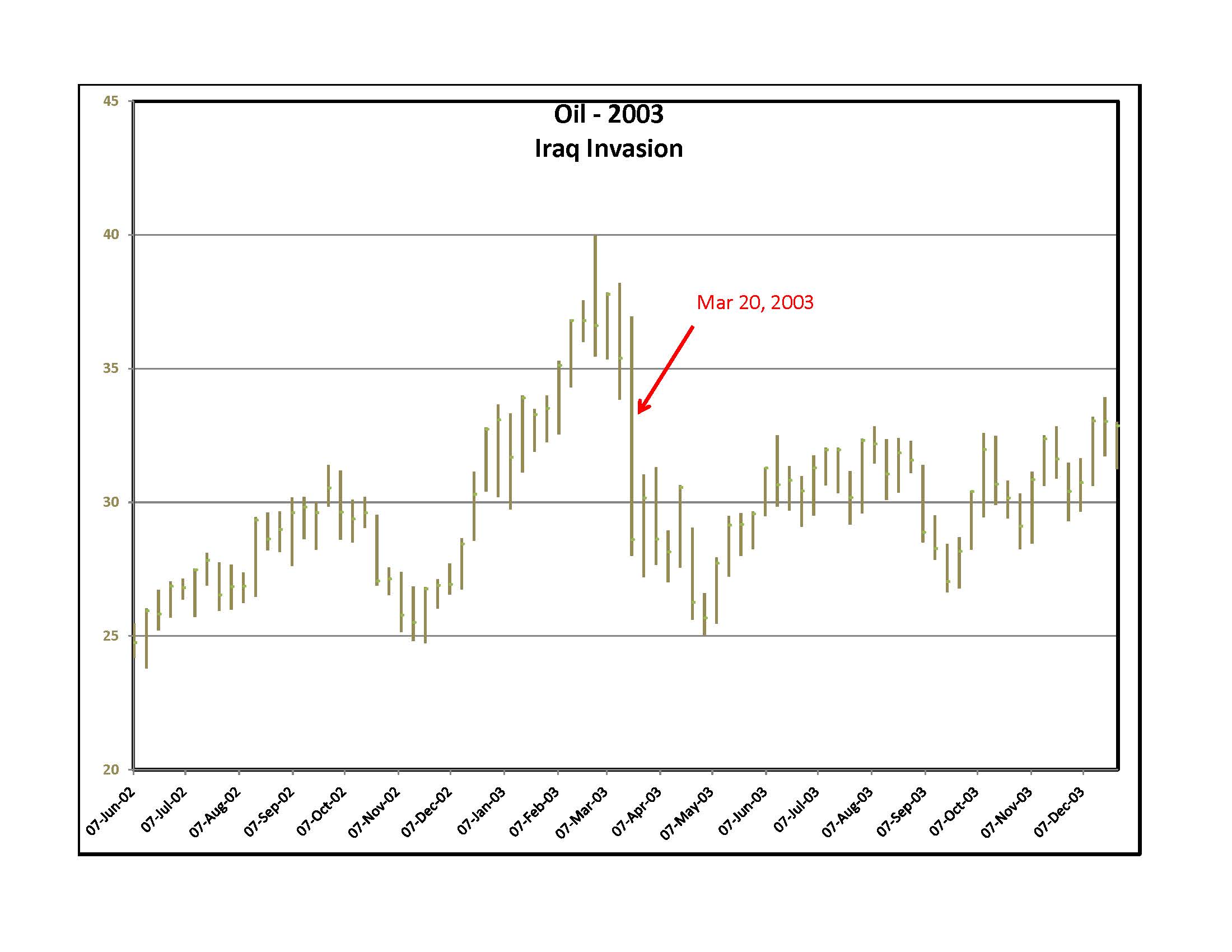

Below are graphs of gold, stocks and oil from two previous invaisons of Iraq.

All three markets went in different directions after the two military interventions. The 1990 war was a quick strike but the 2003 war was followed by a long and bloody nation building effort that ultimately failed. Twenty and thirty years ago, U.S. weapons and technology were overwhelmingly superior to weapons systems in Iraq. The Ukraine war showed the world that lower cost drones, when deployed in swarms, can overwhelm sophisticated, extremely expensive defensive systems. Analysts are saying that our attack and Iran's response will last days, not hours. By the time the markets open on Monday, a lot will have happened and my Saturday guesses will be out of date.

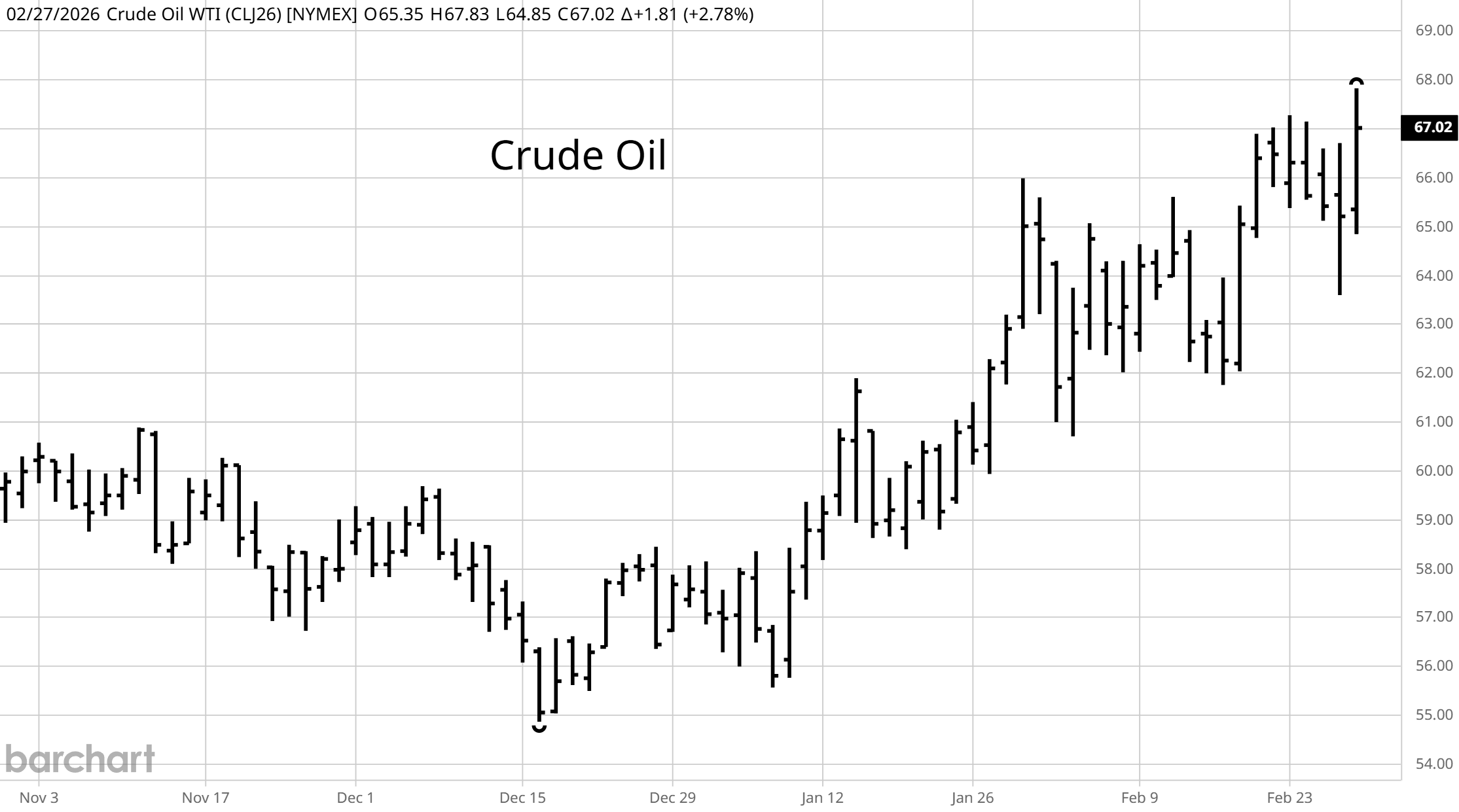

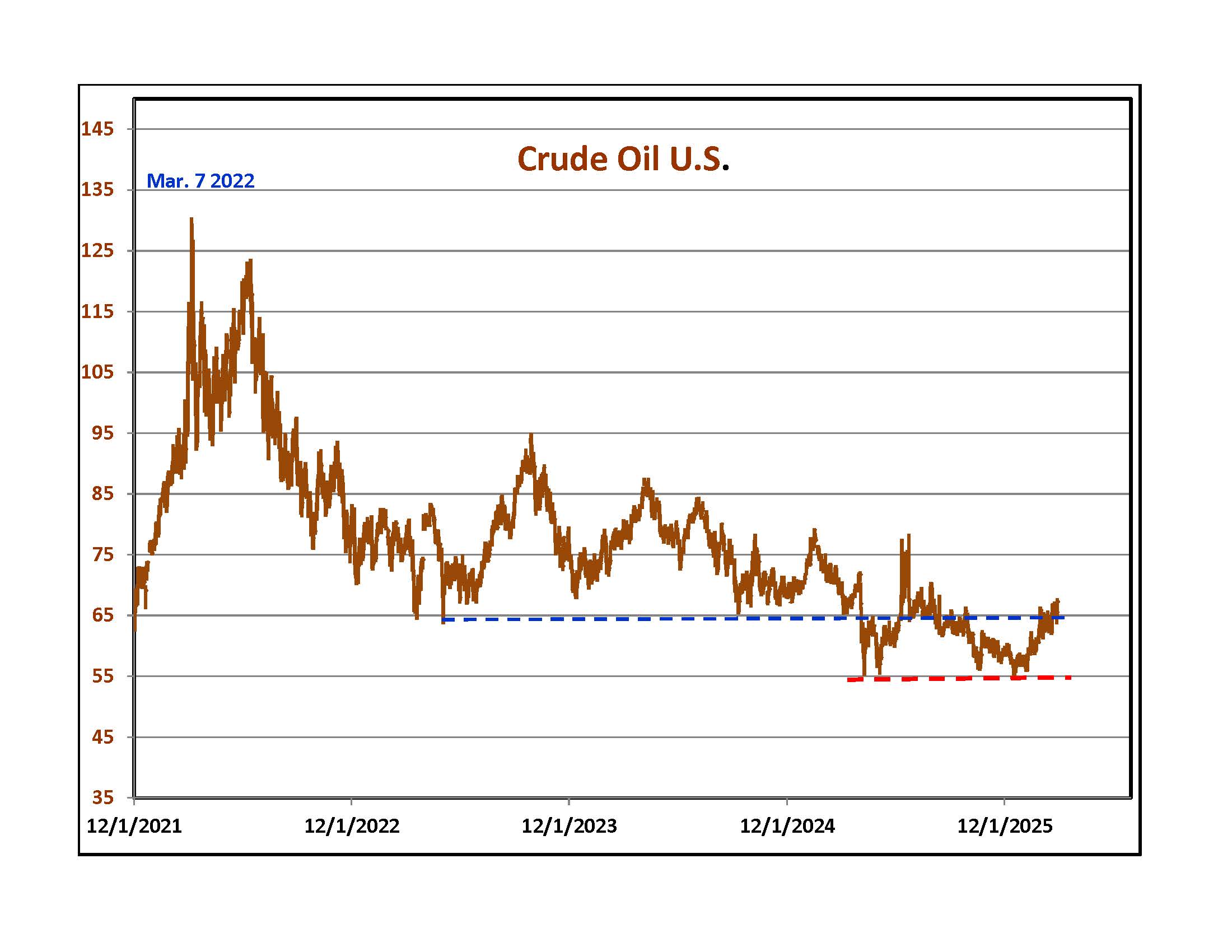

Going into this weekend, oil rallied in anticipation of an attack and Iran's response. On the right is a daily graph of West Texas Intermediate Oil from the time period before the Russian invaison. The area around Iran is a lot more important for oil than Ukraine. It is amazing that prices are so low. The West Texas contract is a domestic U.S. based market. The United States is producing around 13.7 million barrels per day. The current supplies of stored oil, minus the government's Strategic Reserve are around 3% below the five year average for this time of the year. Gasoline is around 3% above the average and distillates are around 5% below. Imports into the U.S. are around 6.4 million barrels a day. The U.S. is well supplied but Europe depends on oil coming through the Straits of Hormuz and so does much of the rest of the world. Oil will react with the news going into Monday morning.

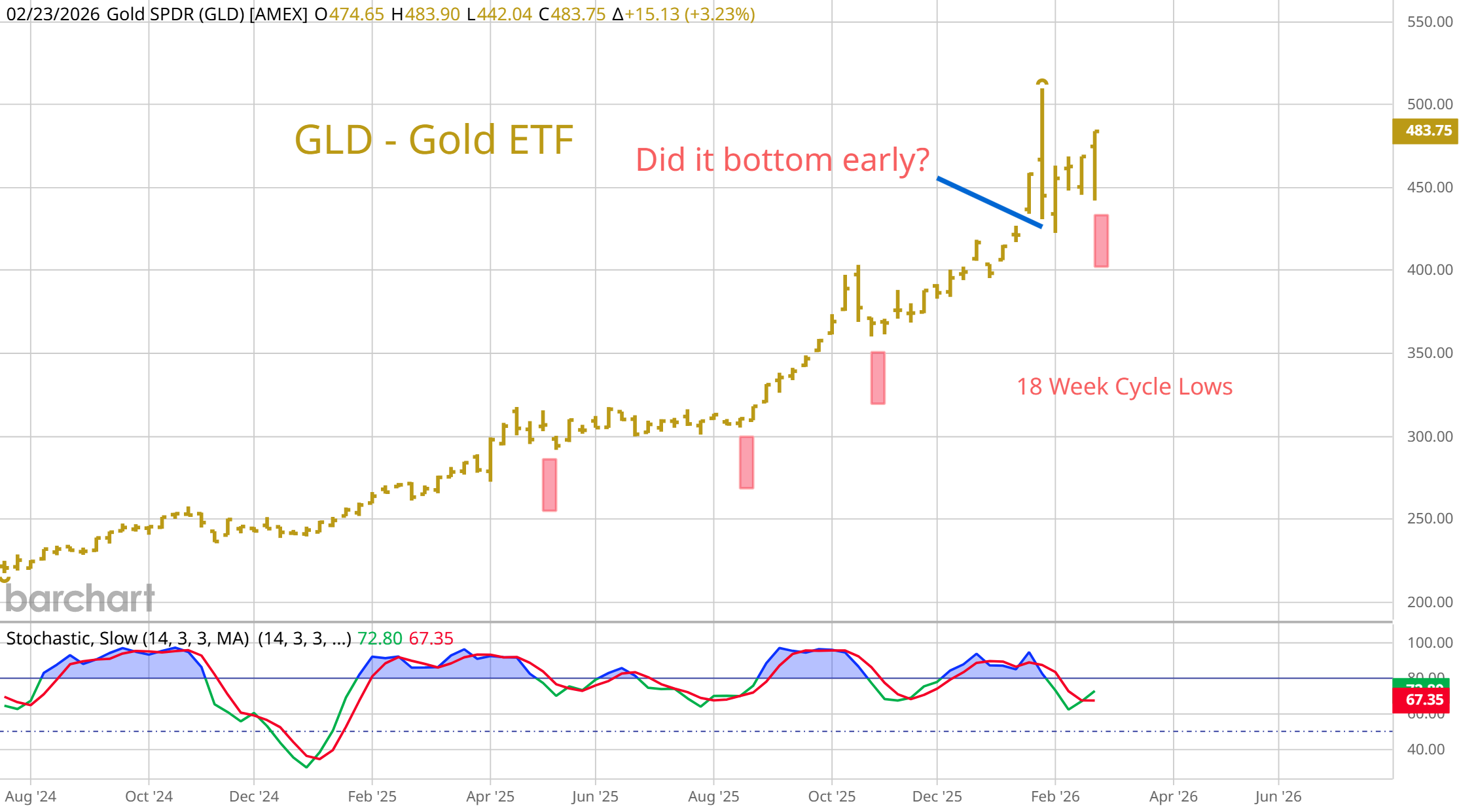

Gold is always a beneficiary of anticipated conflict. Sometimes it peaks just as the bombs begin falling. Above on the left is a weekly graph of GLD, the ETF that closely tracks gold prices. Included are pink markings around Cyclesman.com's 18 week cycle low timing bands. We are in one right now which hints that prices are going to rally over the next month. These cycles expand and contract with 18 weeks being the average time period. It could be that the 18 week cycle bottomed early and is peaking right now or we could get a sell off early next week on favorable war news and make an important low by next weekend.

Gold is always a beneficiary of anticipated conflict. Sometimes it peaks just as the bombs begin falling. Above on the left is a weekly graph of GLD, the ETF that closely tracks gold prices. Included are pink markings around Cyclesman.com's 18 week cycle low timing bands. We are in one right now which hints that prices are going to rally over the next month. These cycles expand and contract with 18 weeks being the average time period. It could be that the 18 week cycle bottomed early and is peaking right now or we could get a sell off early next week on favorable war news and make an important low by next weekend.

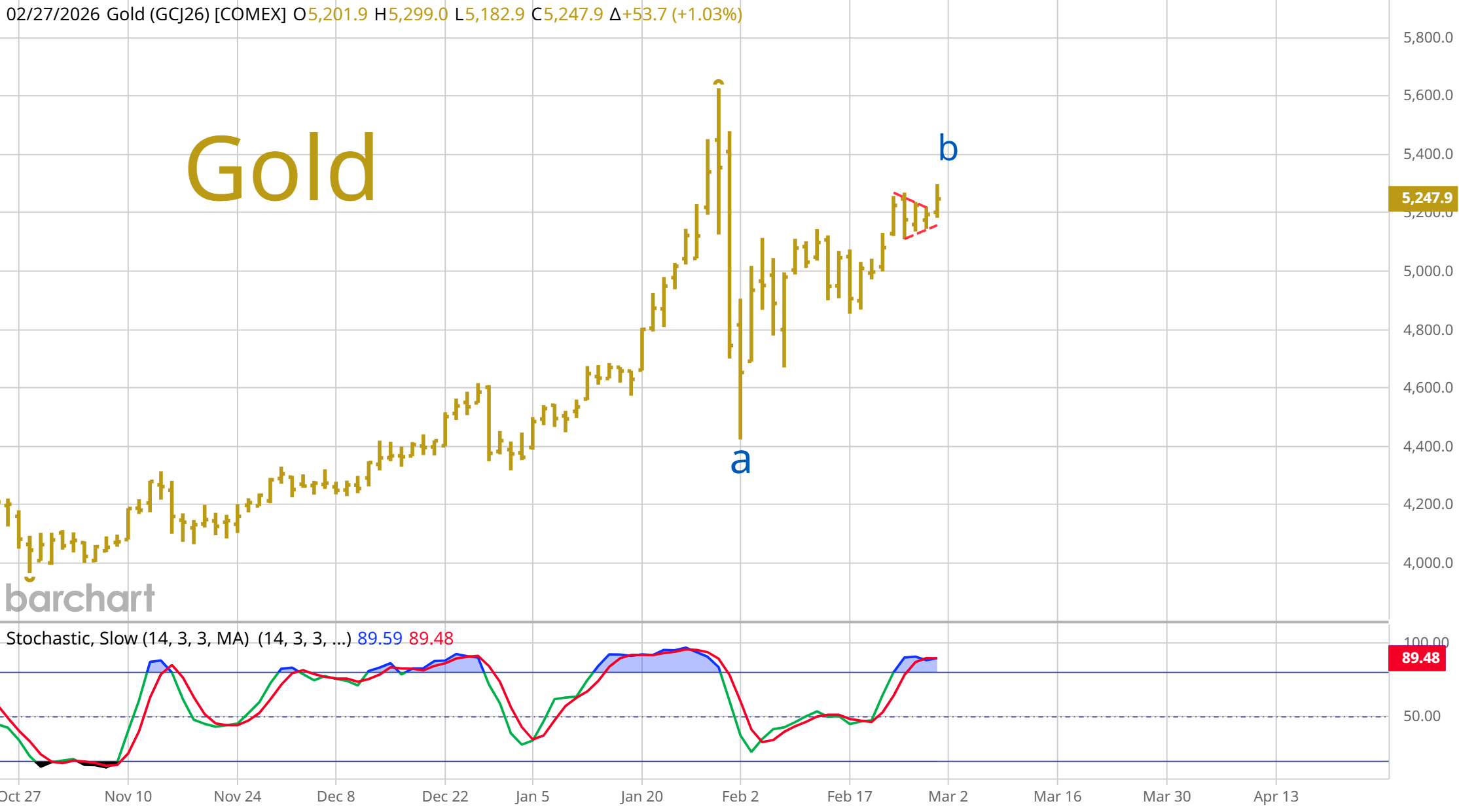

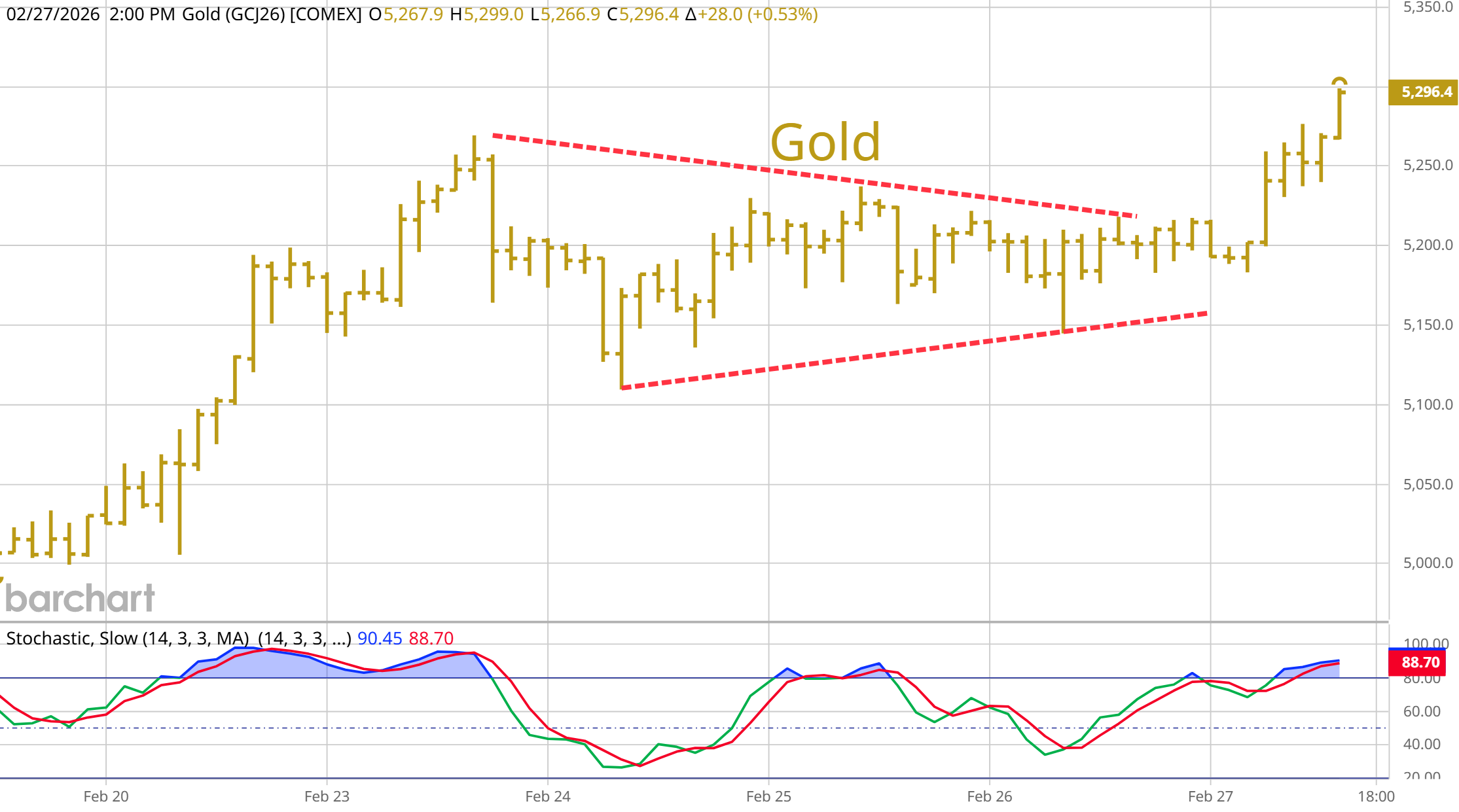

The upper right graph shows daily bars of April Gold futures. Fans of the metal are looking for new highs, but a lot depends on how things go in Iran. We are in the timing band for one of Cyclesman.com's 21 trading day lows. The timing band goes into next week. So far, on the daily graph, the market sold off sharply then rallied in an up, sideways then another up leg. This could all be part of a larger correction. Momentum oscillators on the daily graph are near the high end of their range which reduces your odds of making money on the upside for now. Directly to the right is a four hour bar chart. The pattern between the red lines looks like a contracting triangle formation. These tend to lead to a final spike higher then a reversal. As with oil, news over the weekend will be critical.

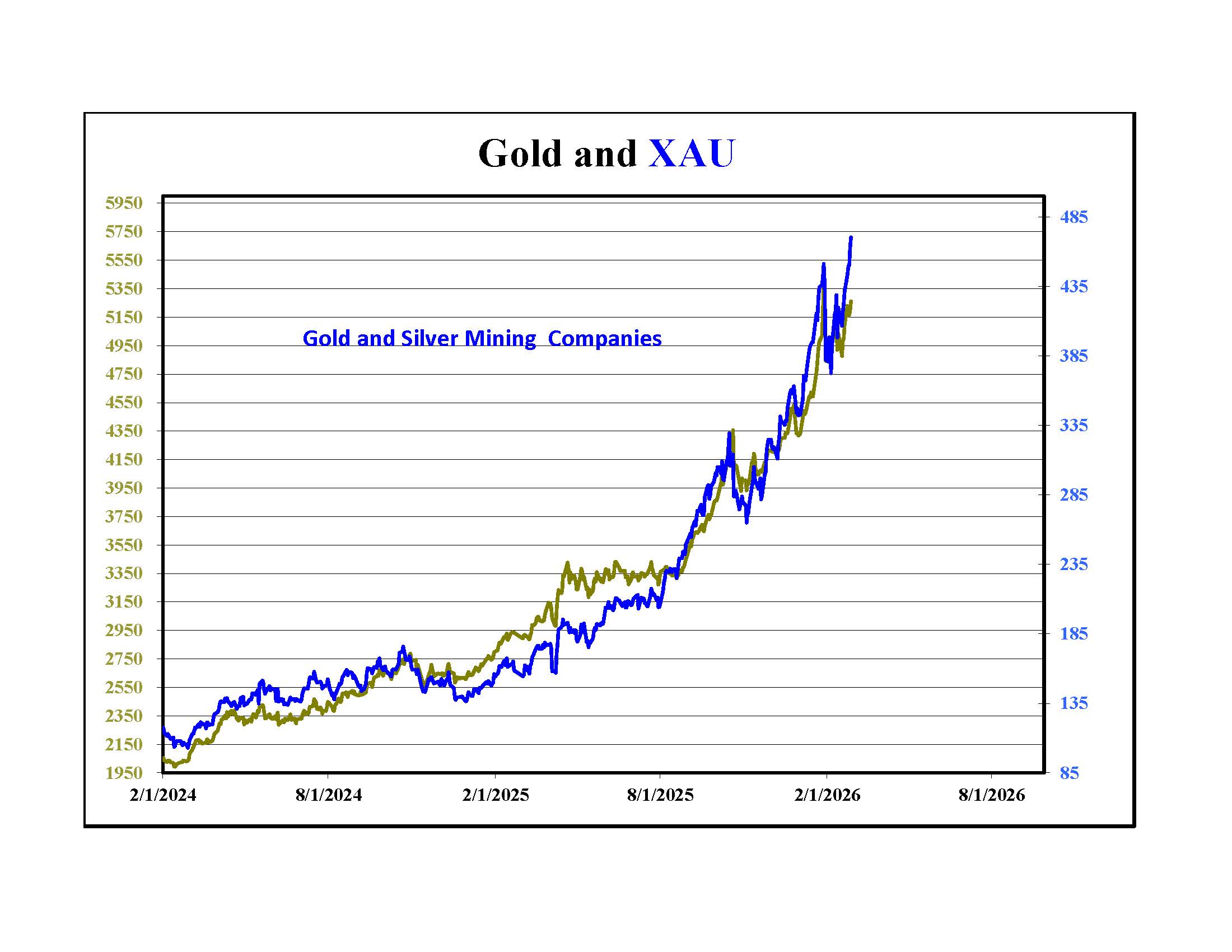

Gold recovered part of its losses and shares of gold and silver mining companies rallied to new highs. In past cycles, the shares hit fresh highs on the first rebound toward the previous top. Rather than being a leading indicator, the better performance was a warning of late cycle behavior. Silver is also trying to rebound but falling short so far.

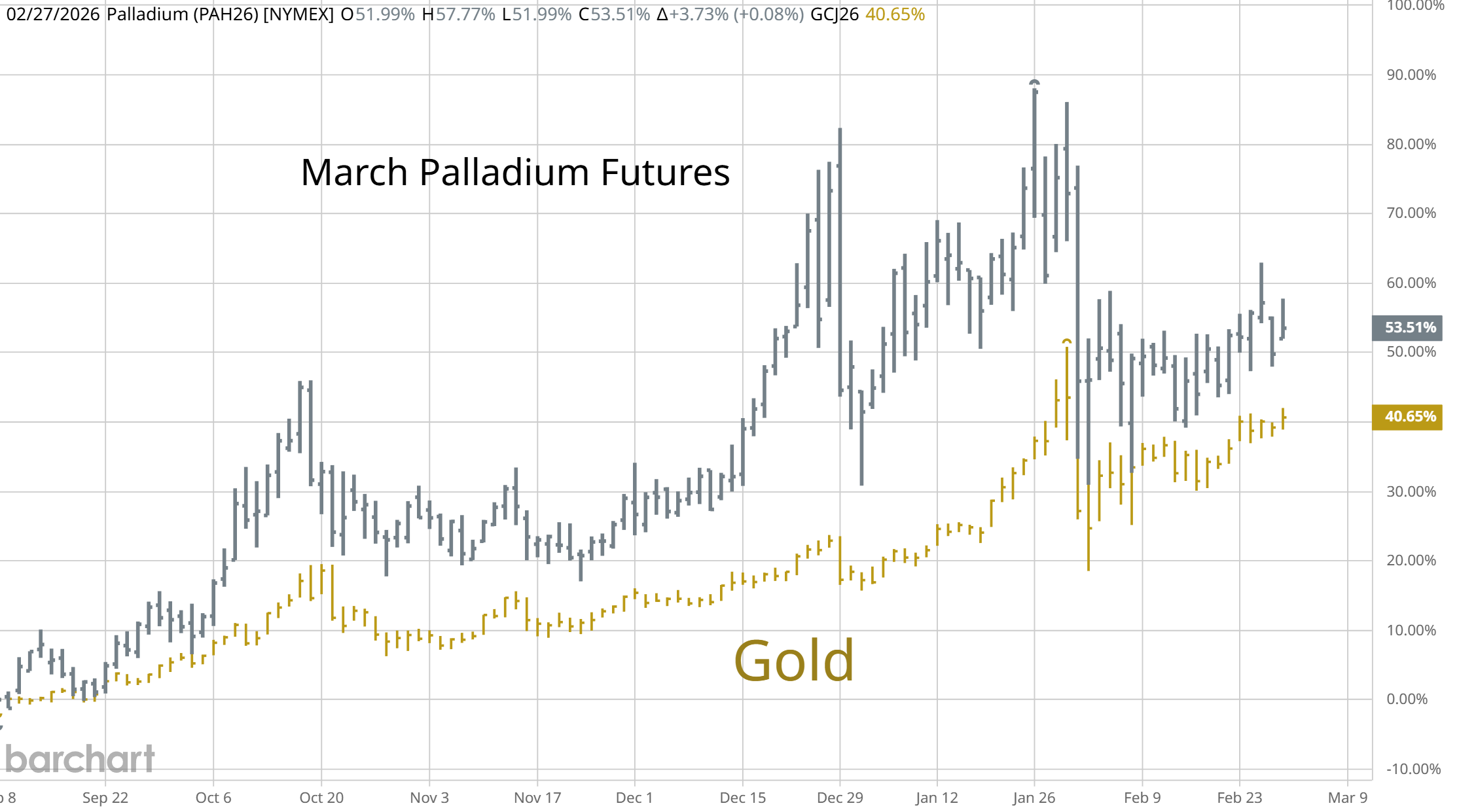

Platinum and Palladium are following gold.

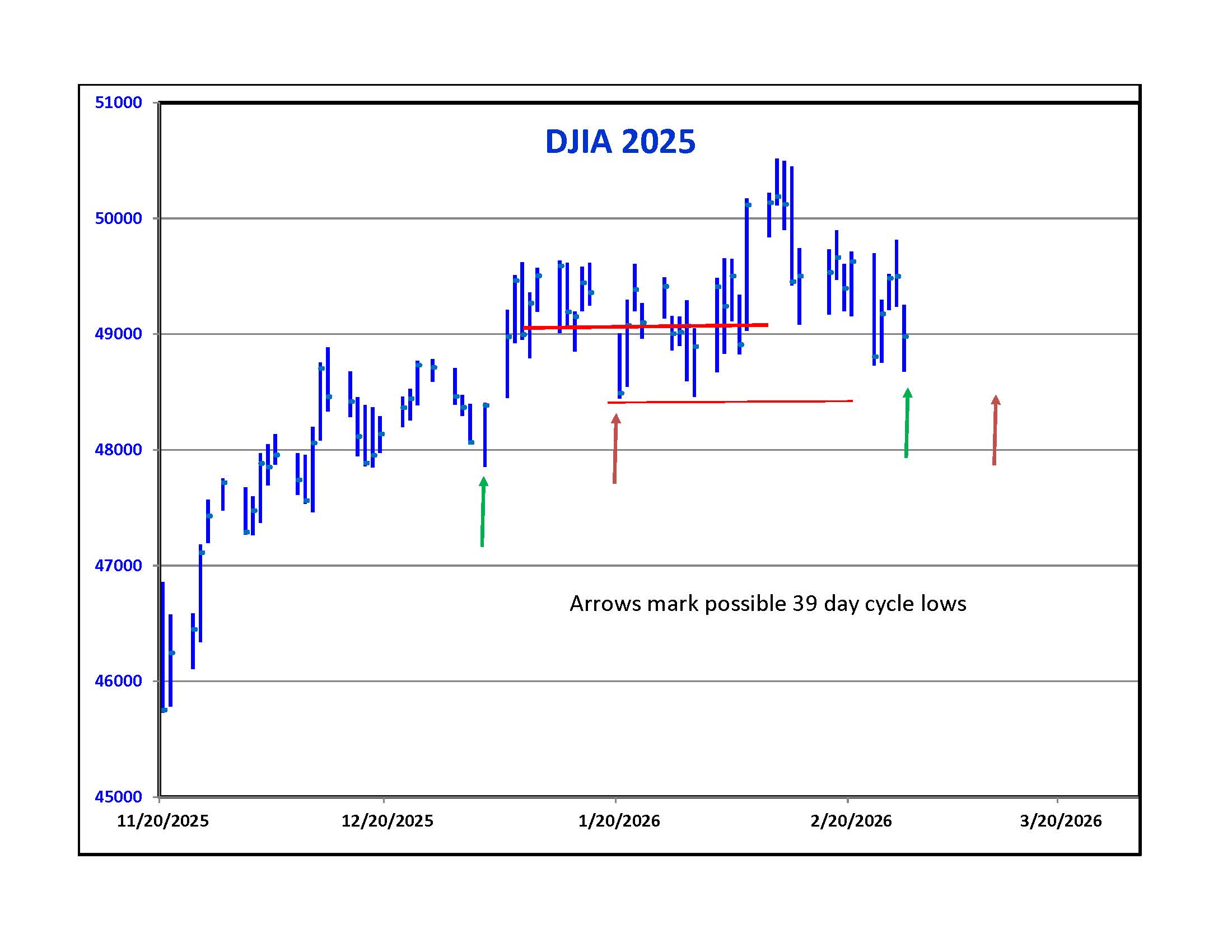

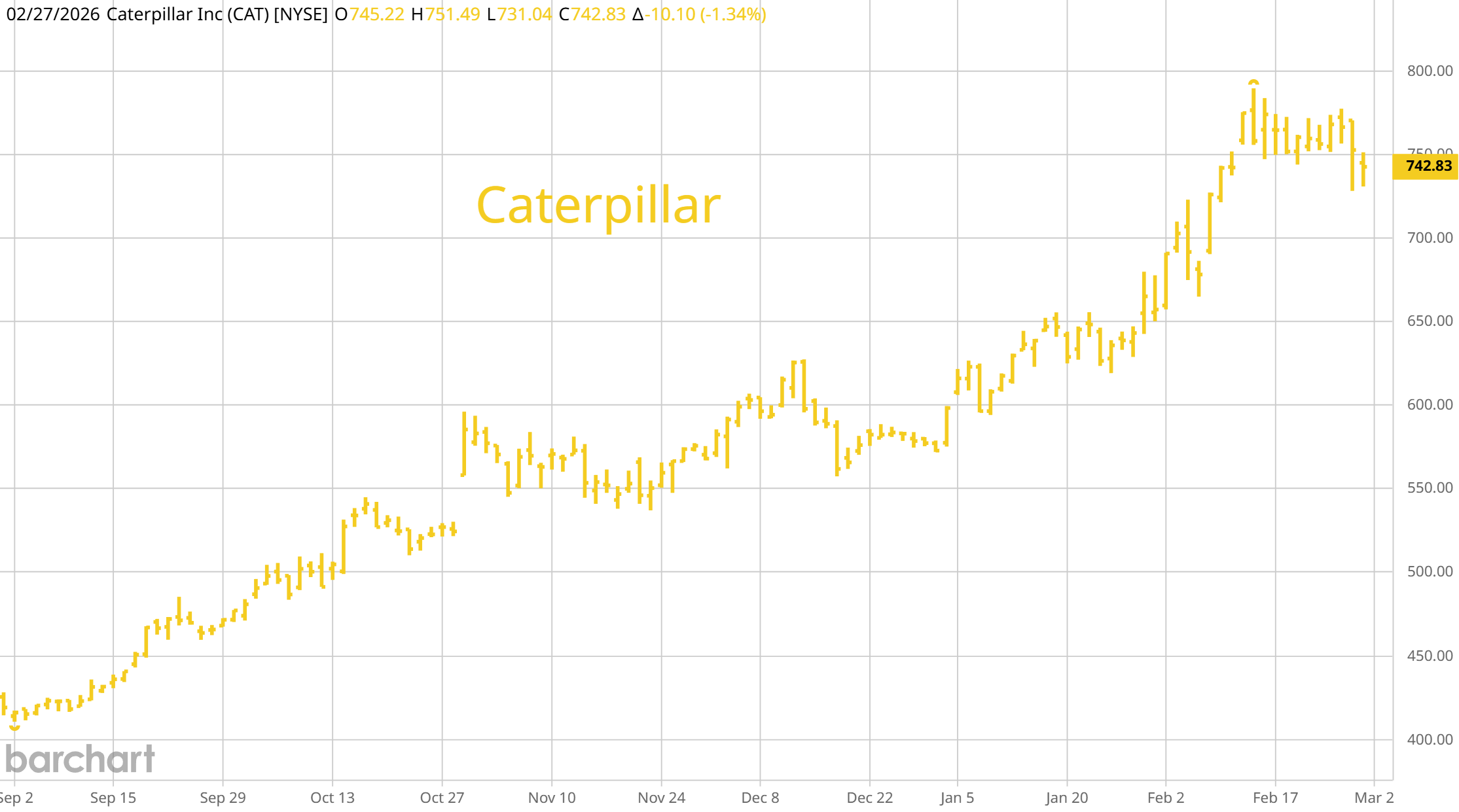

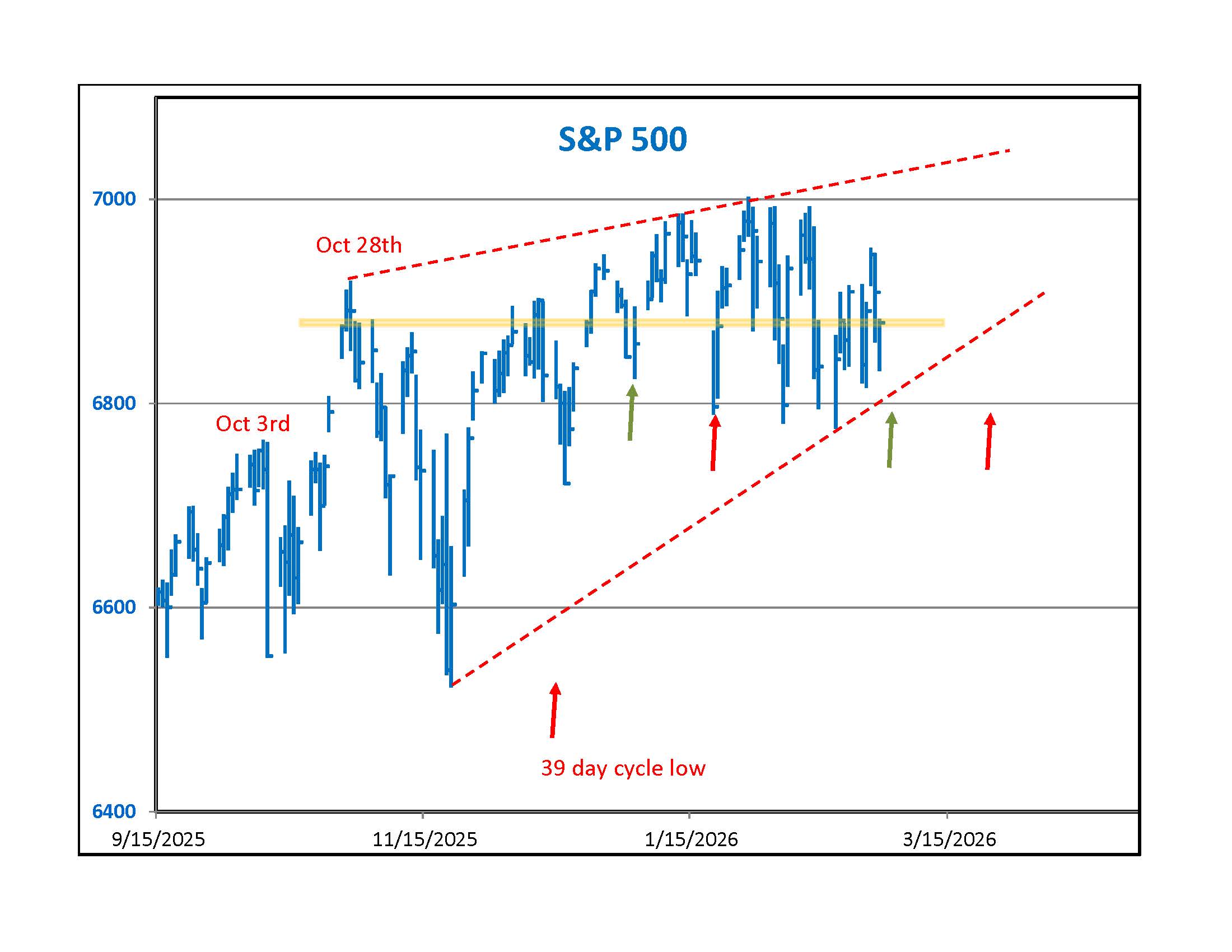

On the left are daily bars of the Dow Jones Industrial Average. The arrows point to possible 39 trading day cycle lows as theorized by Cyclesman. If January 2nd was the last low then this coming week is the timing band for the next one. If January 20th was the bottom of the last cycle then the week of March 9th would be the next target. On the right is Caterpillar, the big construction equipment maker. It is the 2nd most heavily weighted stock in the Dow and is responsible for much of the up move into mid-February. Last time I wrote that it is a key stock to watch for the "build back" theme. It hit its high right around the time I posted my last update.

On the left is the S&P 500 with the same timing band arrows. To the right is its most heavily weighted stock, Nvidia. Earnings came out last week and they were spectacular. A followup conference call was less reassuring.

All the big companies say they will spend even more on data centers this year than they did last year. They are borrowing billions of Dollars and using complicated off-ballance sheet financing schemes to continue buying Nvidia chips that have a 75% profit margin. Nvidia is taking its billions in profits and "investing" part of it back into the AI companies so that they can keep buying their high priced chips. This circular financing is getting harder to justify and not one of these companies presents a good case for how they will ever be able to pay back the current costs for building these things.

The push for AI and the worries about private credit are linked. To the left is an ETF that tracks North American Software companies. A few years ago, Private Credit was a popular fad after Private Equity pools ran out of decent private companies to buy and leverage up for immediate returns. Analysts say that software companies in particular were the beneficiaries of private credit loans. Now, there is a scramble to get money out of these funds. Many have covenants that allow the private credit funds to restrict redemptions. Blue Owl Capital manages a group of them and is restricting the return of capital to investors in some pools. Coreweave leases chips and servers to data center builders and to do this they borrow huge amounts of money to buy the necessare Nvidia chip bundles. Last fall, they were considered to be a cutting edge tech company in the hottest sector of the market. As with the rest of AI, investors are looking at the amount of money they are borrowing and backing away from them. Fitch credit rating service has a BB- credit rating on them. S&P Global is still at B+.

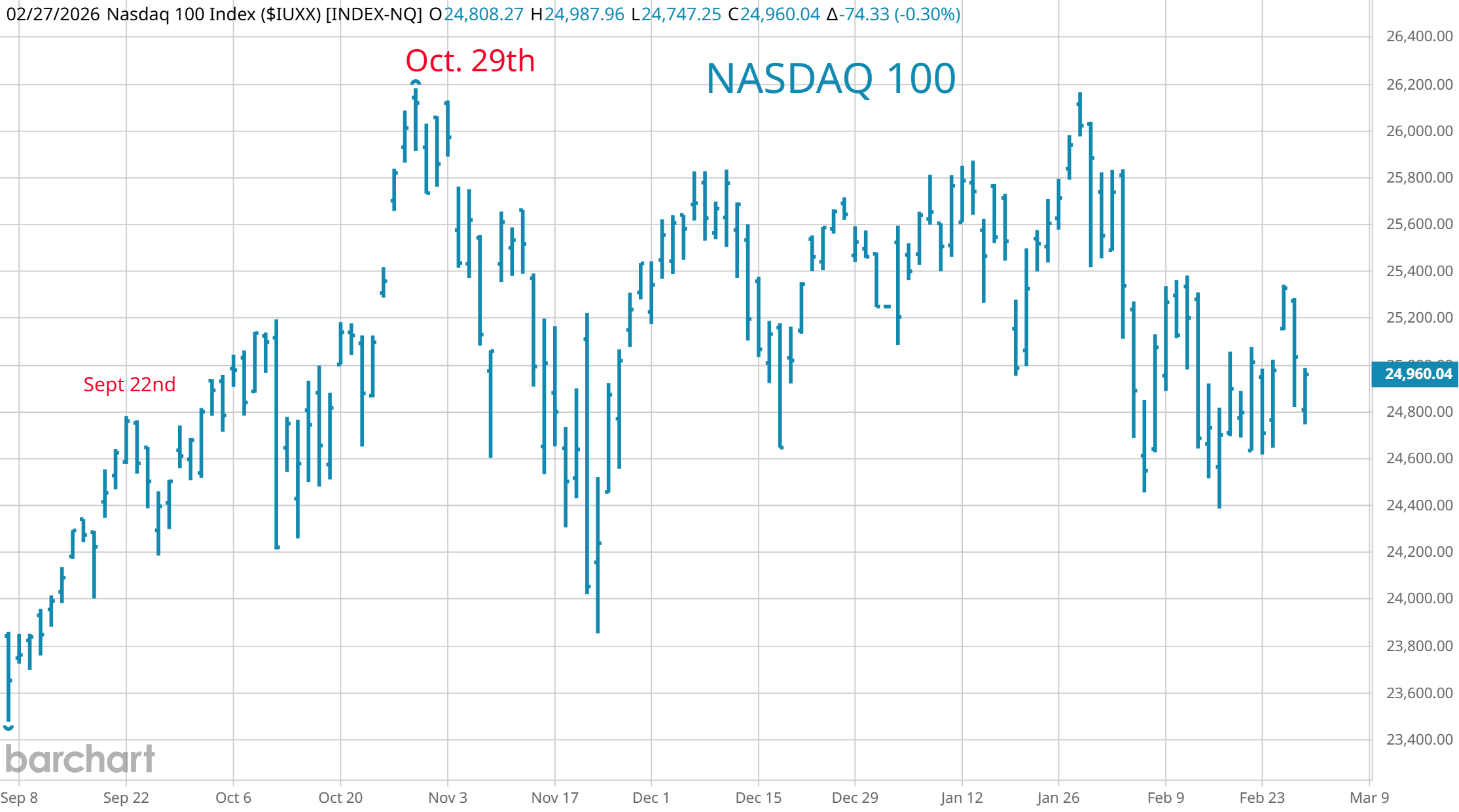

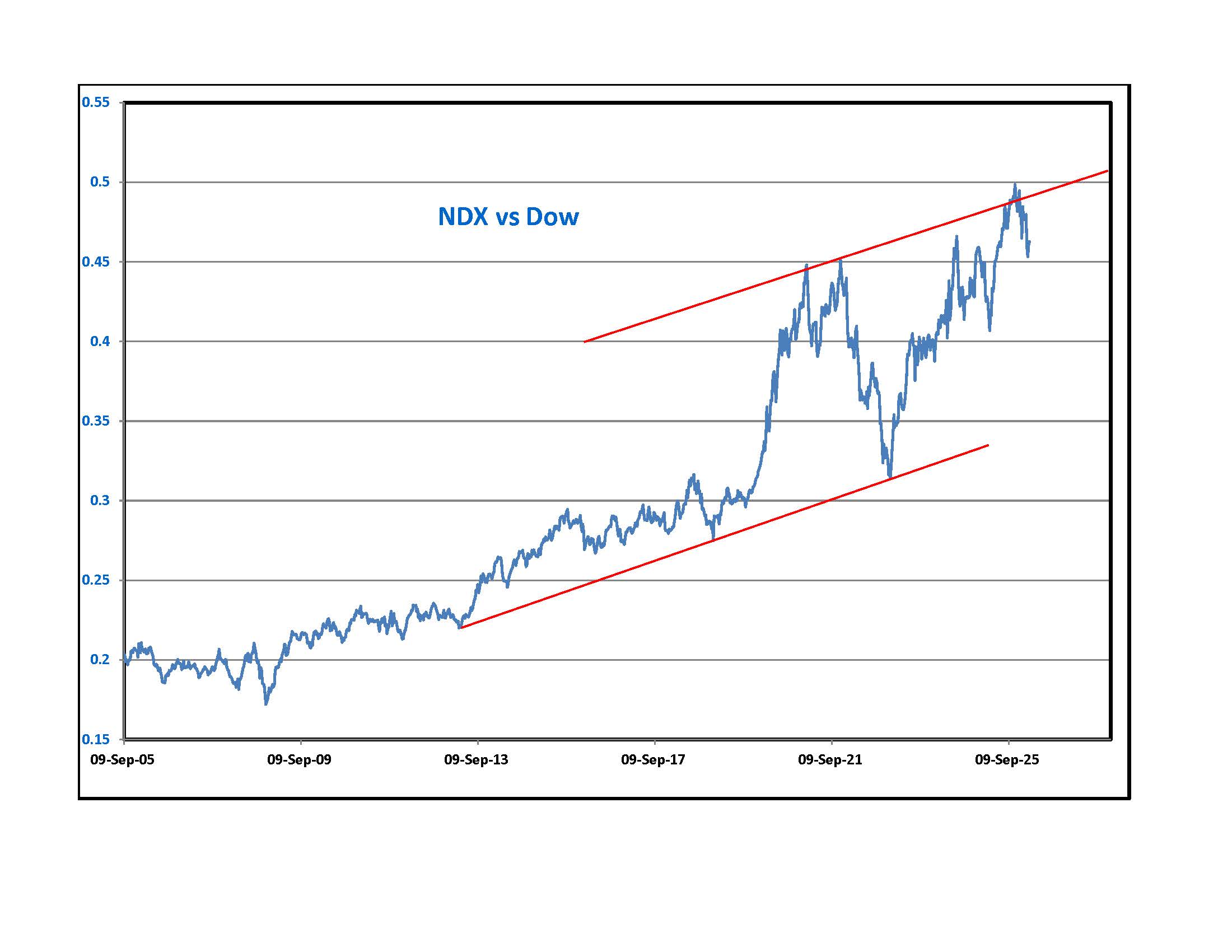

Analysts were predicting that Nvidia's earnings would spark a rebound in the technology sector. The spark lasted a few hours before doubts resumed. On Friday morning, the NASDAQ 100 touched levels last seen in September. On the upper right is a simple graph that tracks the performance of the NASDAQ 100 over the Dow Jones Industrials. If there is going to be some kind of reversion to historical pricing between the two, either the Dow Jones Industrials will have a big rally ahead of it or the NASDAQ 100 is just starting to sell off.

Commentators also say that there is a huge rotation away from big tech and into smaller, more economically sensitive companies that are in the Russell 2000. Since the third week of January, the Russell 2000 traded sideways in a contracting formation. A break to the upside should lead to a final high before a reversal. A close below the bottom red line will lead to more selling. The Purchasing Managers Survey graph shown in the first section of charts has a red line representing hard data and it turned down over the last couple of months. If it continues, small stocks will not do as well as forecast.

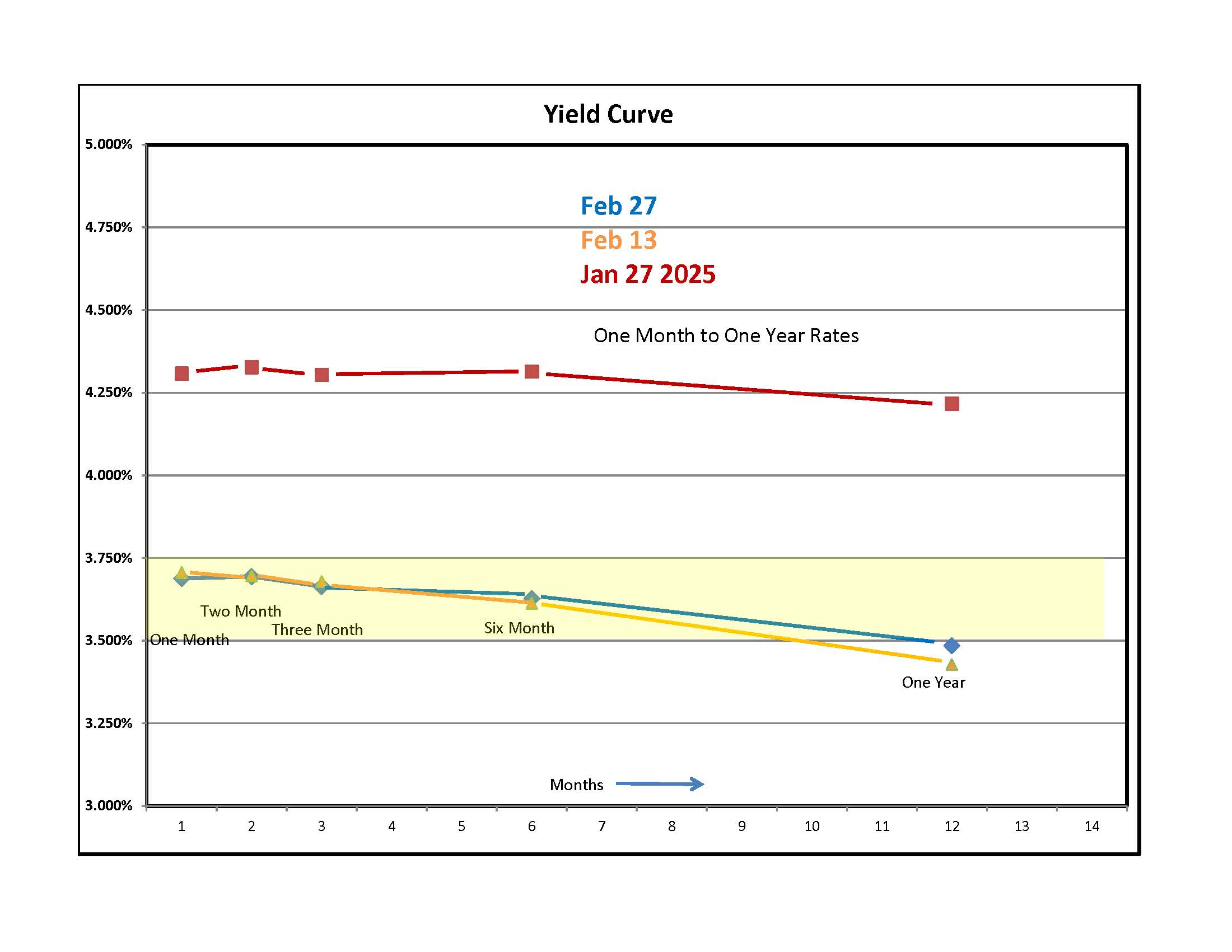

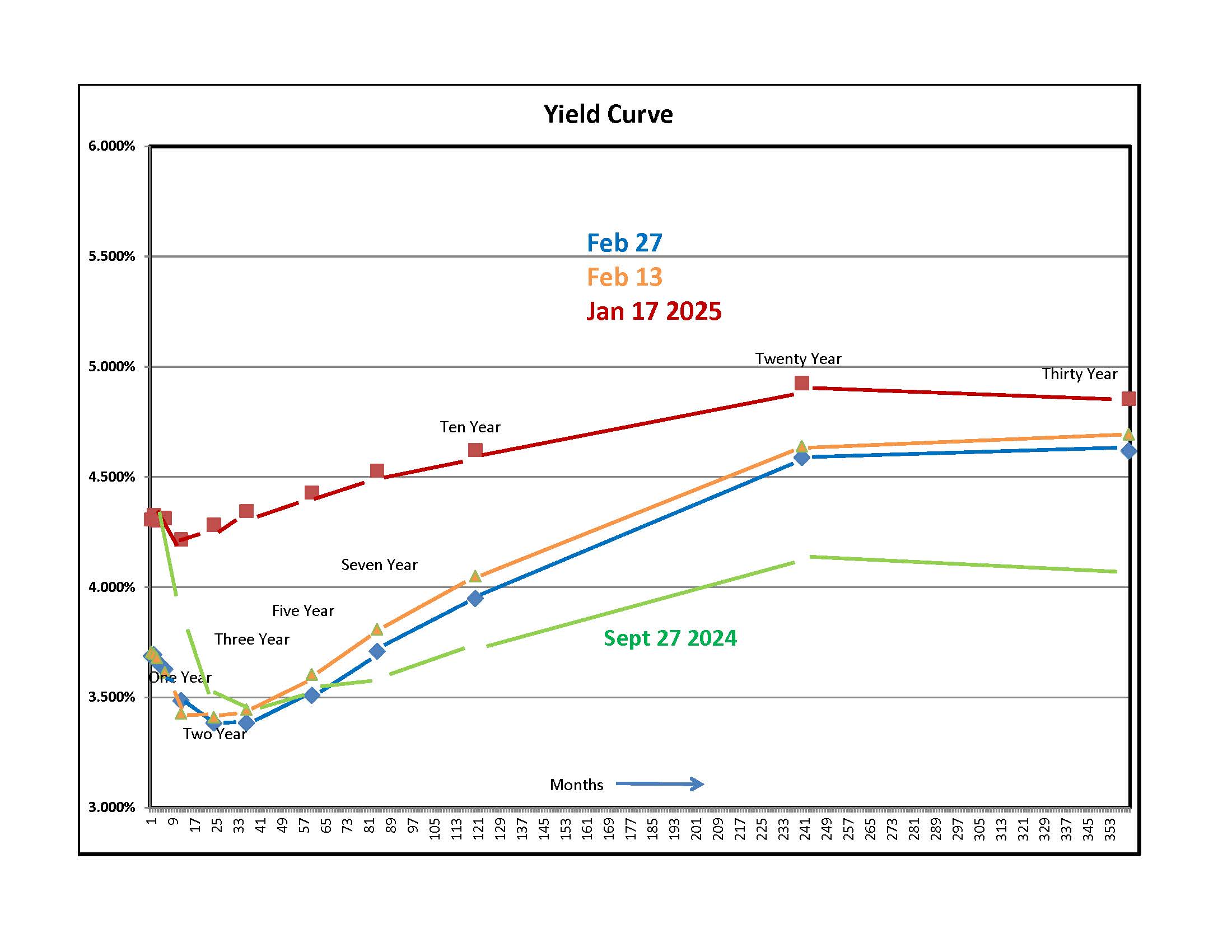

Longer dated interest rates fell last week despite the stronger economic reports. When stocks sell off strongly, government bonds tend to do better with frightened investors looking for safety. During the week, the U.S. warned citizens to get out of the Middle East and evacuated military bases. The problems in Private Credit added to anxiety. This all played into the desire to find a safe haven. Rates at 6 months and one year were higher. If an agreement with Iran is reached and stocks stabilize, bonds will probably sell off.

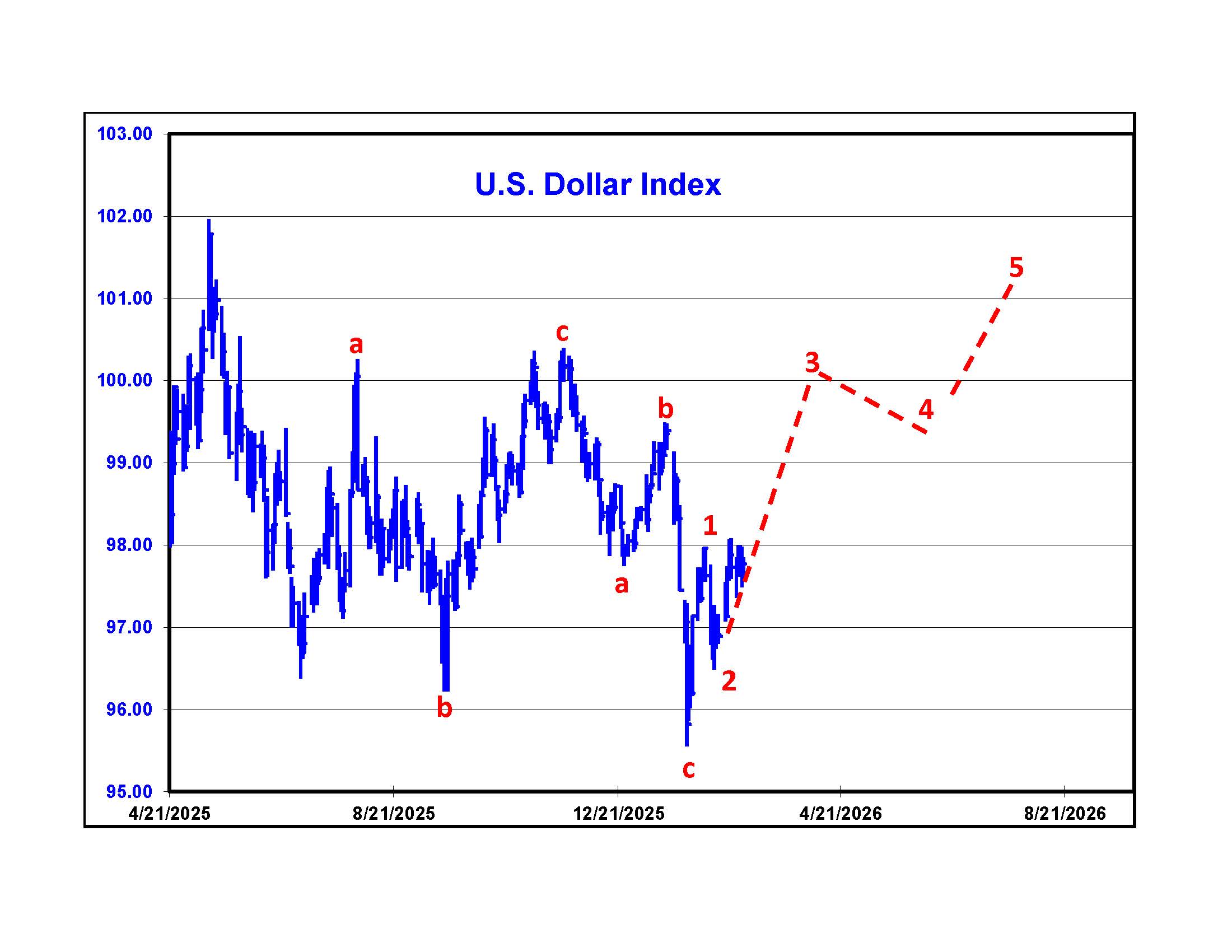

On the left is a daily bar chart of the U.S. Dollar Index. My theory is that it started the third leg of an upward correction. The most heavily weighted currency in the index is the Euro. Europe, and particularly Germany, gave up on fiscal responsibility and they are now borrowing and spending to try and pump up their domestic economy. Japan elected a new Prime Minister who is going all in on more borrowing and spending. The central bank finally let interest rates rise last year. There are reports that the new Prime Minister will appoint more dovish people to the bank who will try and suppress rates. There is an old saying that you can control a country's interest rates or the value of its currency but you can't do both. If the Bank goes back to suppressing rates, the currency will suffer (go higher on the red graph) and the Dollar will do better.

The two upper graphs are popular ETFs that track baskets of commodities. GSG is more heavily weighted by energy and DBC by agricultural commodities. Both rallied recently but are still below prices we saw in 2022, at the height of the COVID helicopter money inflation. Commodities do well in times of war. Even without Iran, the sums that governments are spending are similar to past war time expenditures.

The two upper graphs are popular ETFs that track baskets of commodities. GSG is more heavily weighted by energy and DBC by agricultural commodities. Both rallied recently but are still below prices we saw in 2022, at the height of the COVID helicopter money inflation. Commodities do well in times of war. Even without Iran, the sums that governments are spending are similar to past war time expenditures.

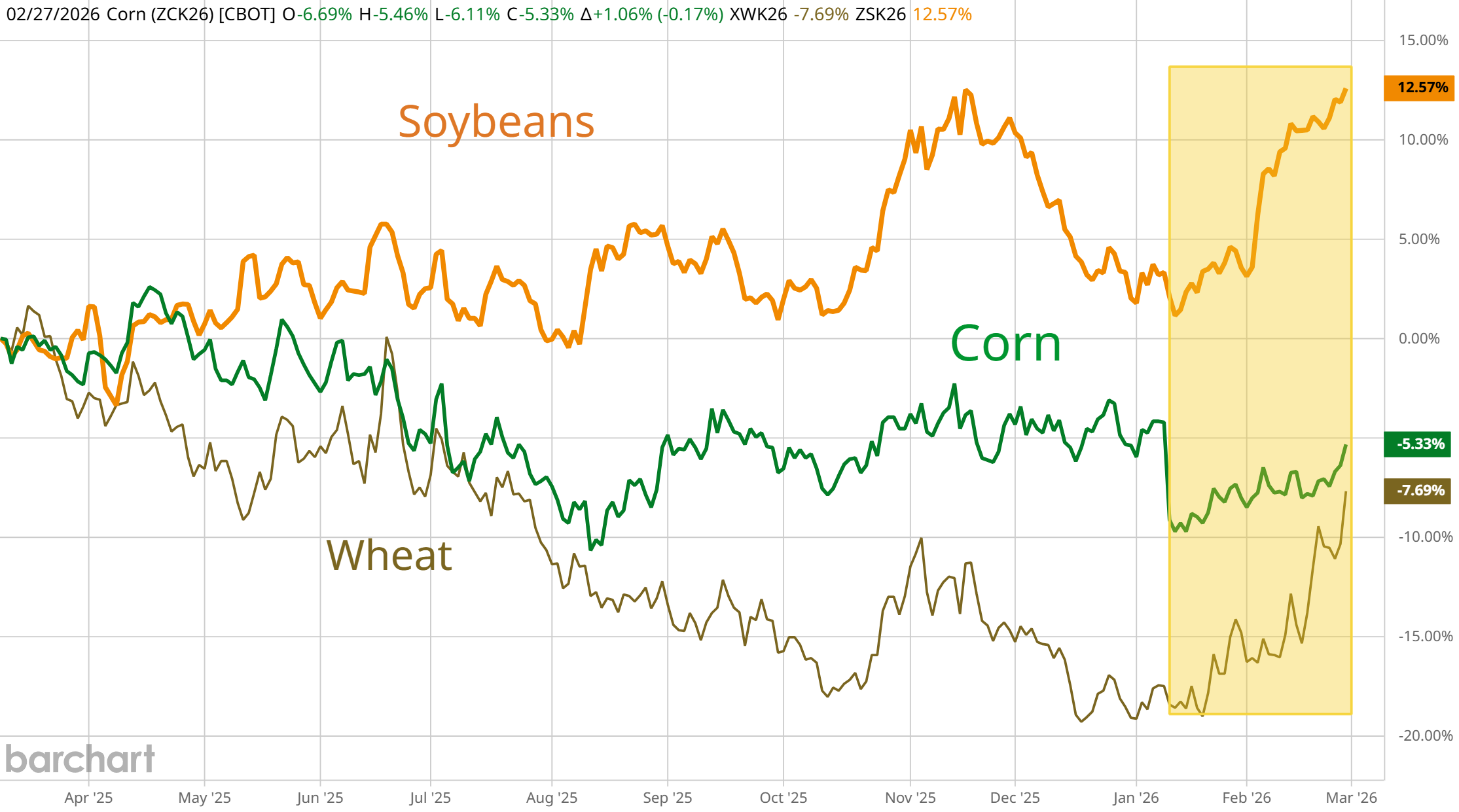

Grains, one of my favorite groups, came to life over the last month. An agreement with China that includes them buying more of our crops would help even more. In the end, grains are all about good and bad weather around the world. Ukraine and Russia are two big grain producing countries. Any escalation that threatens planting season would spike the price of wheat.

Our wheat growing areas are dry. Last fall, weather experts predicted a milder winter for the North East where I live. We got below normal temperatures and a record February snowfall. If the wild weather persists, this could be the year for wheat! OK, I am talking my positions.

Best Guesses -

Stock Market - It is Sunday afternoon as I type this final edit. We are still bombing Iran. There are reports of three ships in the Straits of Hormuz being hit with drones or missiles from Iran. It is generally thought that an agreement with Iran will spark a stock market rebound along with a sell off in gold and silver and oil. Traders are going to take their cue from Bitcoin which responds to the war in real time.

Stock Market - It is Sunday afternoon as I type this final edit. We are still bombing Iran. There are reports of three ships in the Straits of Hormuz being hit with drones or missiles from Iran. It is generally thought that an agreement with Iran will spark a stock market rebound along with a sell off in gold and silver and oil. Traders are going to take their cue from Bitcoin which responds to the war in real time.

The issues with Private Credit and AI skepticism are still with us. If we continue selling off next week, I will look for a low the week of March 9th.

Bonds - If an agreement is reached and stocks rally, the flight to safety bid should reverse and bonds will sell off.

Dollar - The winners of war usually see a stronger currency. Pundits have been saying that China, Russia, N Korea and Iran will work together against the U.S. One name just came off the board.

Gold and Silver - A quick end to the war or just the belief that it will not be as bad as imagined will be bad for gold and silver.

Other commodities - If they rallied because of Iran and things go better than anticipated, they should pull back.

Best of luck,

DBE